by Nick Taylor

Spring blooms in Hyde Park on the Hudson River and Franklin D. Roosevelt must be smiling in his grave. Fighting the Great Depression of the 1930s, he created a “new deal for the American people” that unlocked their access to the great bounties of our country. Now a new generation calls for a Green New Deal. A smart, bold Green New Deal can use the Roosevelt playbook in the same way.

First, Roosevelt jumped on bold ideas.

He created the Civilian Conservation Corps that sent young men to restore national parks and forests where they planted three billion trees.

His Tennessee Valley Authority built dams that electrified rural Appalachia and lifted the region out of abject poverty.

He backed a plan to generate electricity from the rise and fall of the tides in Passamaquoddy Bay in northern Maine. Congress ultimately blocked it but today Scotland draws hydropower from the tides with turbines anchored to the floor of the North Sea.

The New Deal’s job-creating engine, the Works Progress Administration, put men and women to work in every county, state and U.S. territory.

In Ohio, in a precursor of the Green New Deal, miners cut gaps in coal seams to extinguish an underground fire that had been burning, spewing methane and carbon dioxide, for more than fifty years.

Workers paved roads and improved sidewalks, repaired bridges, installed new water lines and built hospitals, stadiums, schools and golf courses.

Teachers laid off by impoverished local school boards taught for WPA paychecks. Bookbinders repaired tattered books in libraries and schools. Artists painted murals, writers chronicled the times.

In eastern Kentucky, women loaded saddlebags with magazines, books and catalogues and carried them on mules to isolated families and schools.

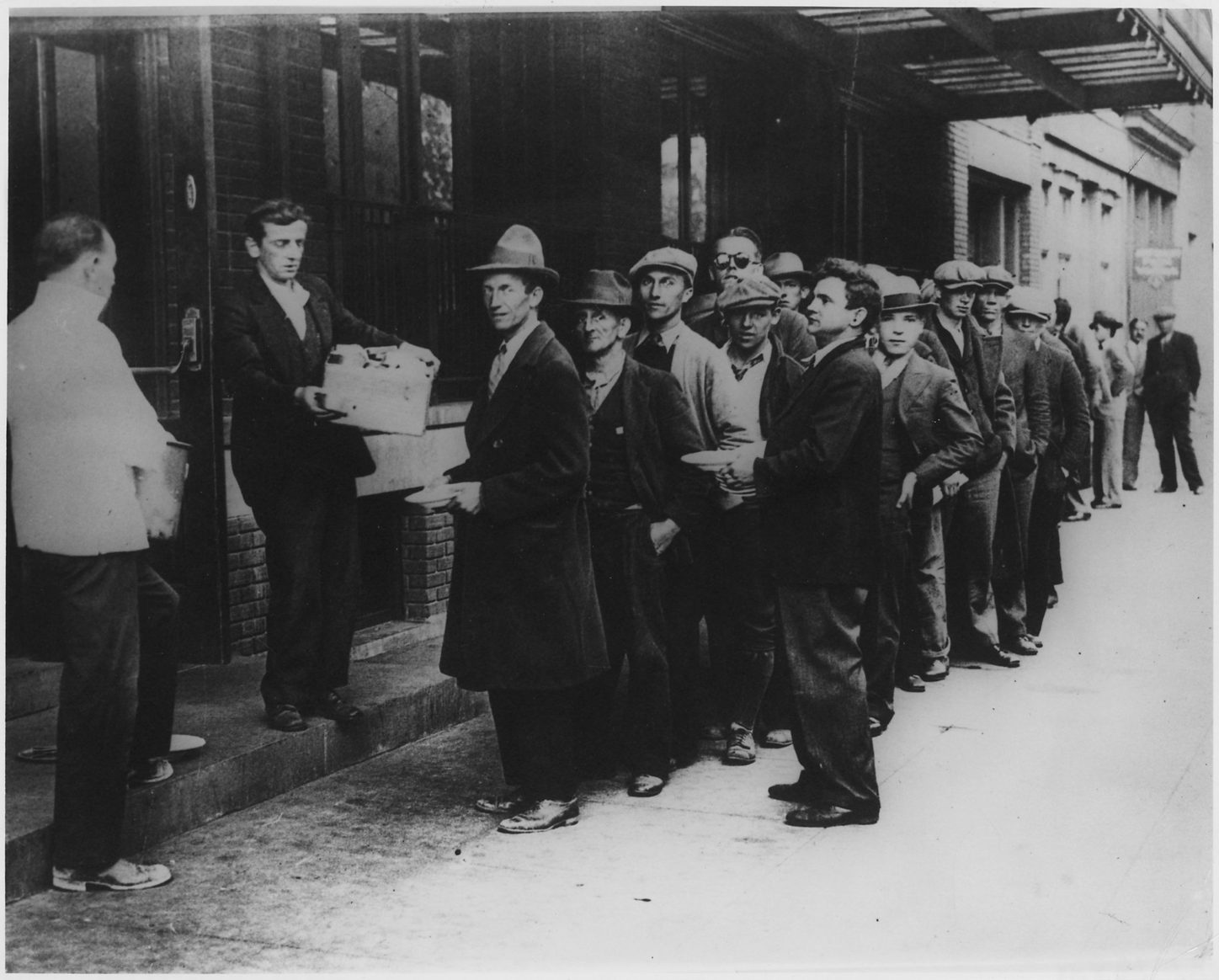

All this work brought new hope to an America in despair from the Depression, when 25 percent of workers had no jobs, homeless families lived in shantytowns, and city food lines stretched for blocks.

Real change followed on the heels of hope. Social Security and unemployment compensation created pensions and security for workers. Union collective bargaining raised wages. Banking laws protected depositors and encouraged homebuyers. Price supports and enforced crop rotation restored the depleted farmlands of the Dust Bowl.

A smart, bold Green New Deal can use the Roosevelt playbook in the same way. The New Deal showed Americans what it was doing. People saw the thousand small ways their communities improved, and that produced support for the big programs that followed.

Local initiative is the second takeaway.

FDR’s New Dealers believed people at ground level understood better than Washington what their communities needed. Federal dollars (mostly) paid for the flurry of transformative work around the country, but the idea for those projects bubbled up from state and city governments and even some private entities. This removed the work from the taint of national arguments over ideology. Nobody from someplace far away, some fancy orator with a point to prove, was shoving anything down people’s throats.

Critics scoffed and called many of these jobs “boondoggles,” a term for make-work tasks of little value. Cartoonists drew “WPA shovels” equipped with fold-down seats and arm rests. But thousands of these sturdily-built projects, maintained and restored, remain part of the American landscape. Many of us learned in WPA-built classrooms, read in WPA libraries, and camped at CCC-built campgrounds that will serve generations yet to come.

None of this was easy. FDR faced virulent critics. Boondoggles was a gentle word compared to most. “Socialism!” was much scarier, and conservatives blared it every chance they got to suggest that a government that was simply doing a good job aimed to take away their “freedom.” But Roosevelt and his team kept their eyes on the important things and pushed ahead.

That’s the third point. Conservatives have no new ammunition, so they dusted off their one-word arsenal from eighty years ago to lob at the Green New Dealers. They hope the same scare tactics will distract voters from the abundant evidence that calls for action, fast. But today’s New Dealers have the ear of younger generations and a better story. It’s a story about hard work and changes that can sweep the nation and improve home towns. Americans who believe in a future that their country, its children, and the world deserve are listening.

For more about the WPA, read my American-Made: The Enduring Legacy of the WPA, When FDR Put the Country To Work.