by Barbara Nevins Taylor

There’s a lot of talk lately about “the little guy” and who protects average Americans. If you are one of the average Americans who has a student loan, wants to borrow money, sign up for health insurance, or protect yourself against financial predators, there’s plenty to worry about when it comes to consumer rights.

For now, just think about student loans and what’s happening at the Department of Education (DOE) in Washington.

The Department of Education under Secretary Besty DeVos scaled back protections for students defrauded by for-profit-colleges that didn’t deliver the education that they promised.

Under her orders, the DOE is also trying to stop states that go after for-profit schools that defraud students. It supported a lawsuit by the Student Loan Servicing Alliance, a trade group, against the city of Washington, D.C. for setting up a student loan ombudsman office, according to The New York Times. Not a plus for the average American here.

The Department of Education also plans to cut back rules that aimed to rein in for-profit-colleges. The Obama administration set up rules to cut off federal aid to for-profit colleges whose students couldn’t find the gainful employment they were promised.

Consumer advocates have denounced the moves aimed at helping the industry and predators.

The National Consumer Law Center‘s Aby Shafroth said, “The gainful employment rule is a basic, commonsense safeguard designed to protect students and taxpayers by ensuring that federal dollars do not flow to schools that consistently fail to deliver sufficient value to students to enable them to afford their student loans. The rule protects millions of Americans enrolled in career training programs and provides incentives for schools to reduce their costs and increase their value.”

The Century Foundation, a non-partisan think tank, says the DeVos actions hurt students and help the industry. It suggests the changes made by the Trump administration will make it harder for victims of scams to sue companies that defraud them, and force students to default on their loans before they can get debt relief.

The steady erosion of support for average Americans, students in particular, led to the resignation of the Consumer Financial Protection Bureau‘s (CFPB) student loan ombudsman, Seth Frotman. He sent a scathing letter to the CFPB’s acting director, Mick Mulvaney, who also heads the Office of Management and Budget, saying the bureau had abandoned consumers and was no longer enforcing the law.

The CFPB, during the Obama years, returned more than $750 million to student loan borrowers. And the Obama administration also forgave $450 million in federally-backed student loans that went to colleges where the students got worthless degrees.

Frotman said, “The current leadership of the bureau has made its priorities clear — it will protect the misguided goals of the Trump administration to the detriment of student loan borrowers.”

He went on to say, “Unfortunately, under your leadership, the bureau has abandoned the very consumers it is tasked by Congress with protecting. Instead, you have used the bureau to serve the wishes of the most powerful financial companies in America.”

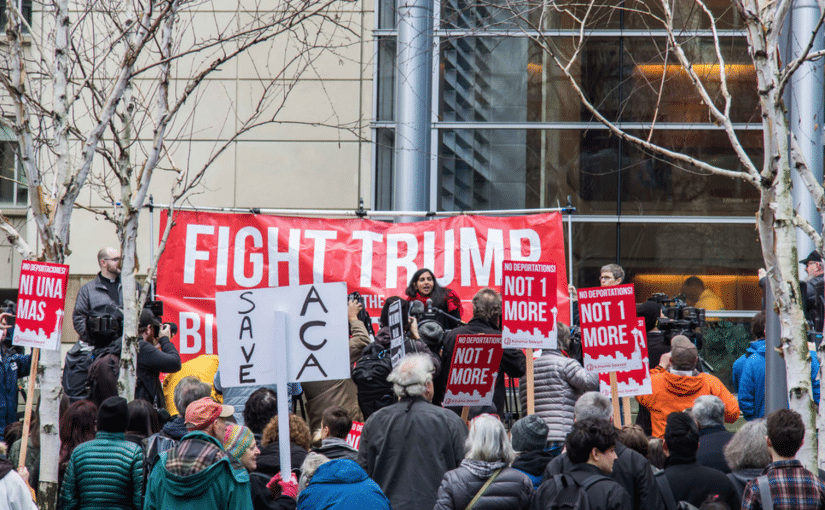

So what happened to the promises to protect the average American?

If this makes you angry and it should, vote and encourage others to vote.