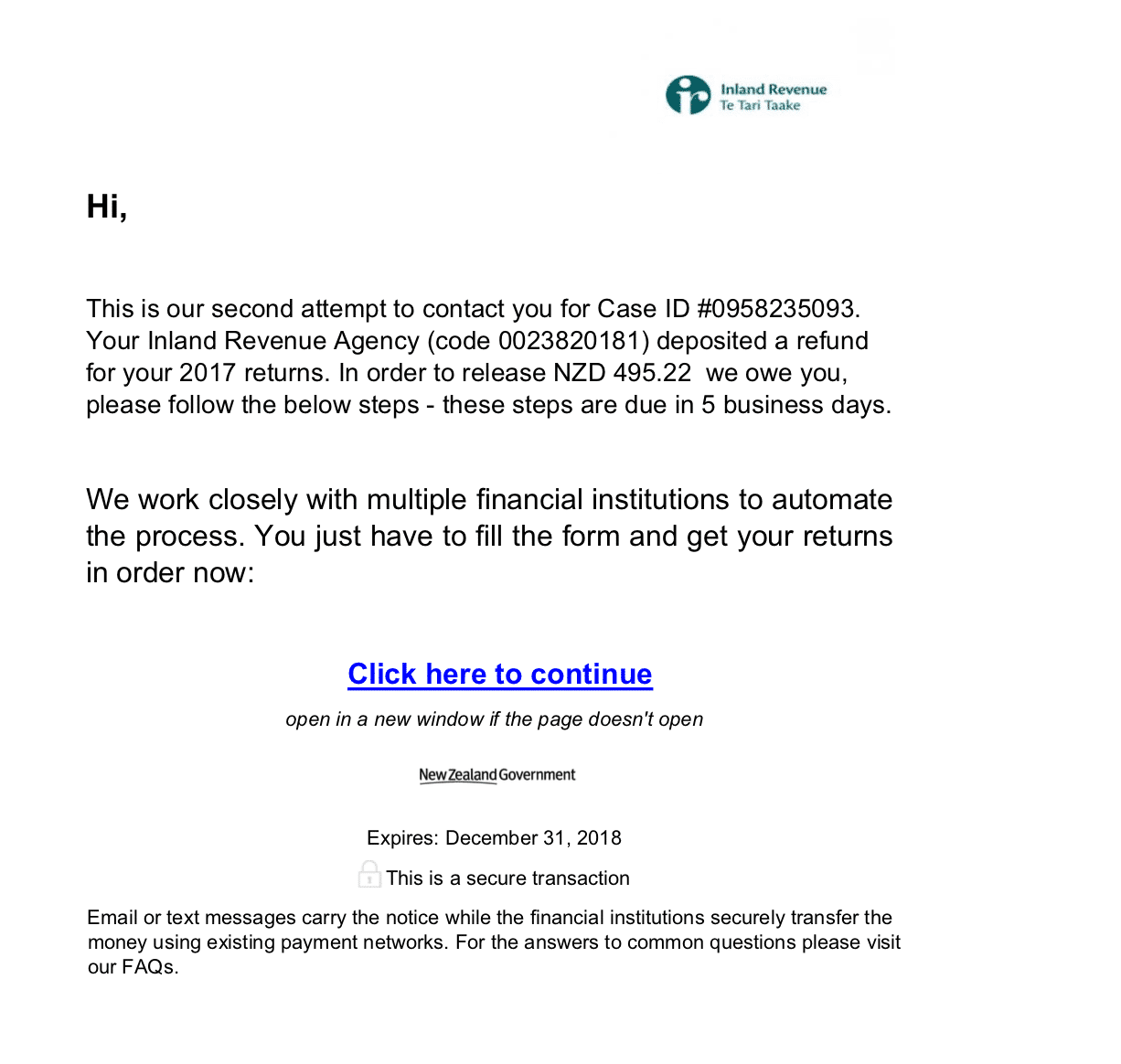

Scammers sending email about a mystery tax refund keep trying to bait us. The latest tax refund email phishing scam popped into our inbox as a message from the “Inland Revenue Agency” claiming that money awaiting us in our account. All we had to do was click “here to continue.”

First of all, the United States doesn’t have an Inland Revenue Agency. A careful read shows you this purports to be from New Zealand’s tax agency, supposedly a VAT tax refund that you’re due. But many of us just read “refund.” And here the U.S. Internal Revenue Service advice still applies: the IRS warns that we should not click on any links in the phishing scam emails.

An IRS alert says there is a “surge of fraudulent emails impersonating the IRS . . . as bait to entice users to open documents containing malware.”

Here’s the danger: malware can steal personal information, including your Social Security number, stored in your computer and this particular type of malware is difficult to delete, according to the IRS.

Once the criminals get your personal information they can file a fake W-2 in your name and claim your tax refund and other benefits. They are also looking for freelancers and small business Employer Identification Numbers.

IRS Commissioner Chuck Rettig said, “. . . as tax season approaches, the IRS and the Security Summit partners continue to warn employers to be on the lookout for emails asking for sensitive W-2 information, a dangerous scheme aimed at payroll and human resource offices.”

The problem is you often don’t know something is amiss until you discover situations like these:

- More than one tax return was filed using your SSN or your Employer Identification Number.

- You learn that you owe additional tax, refund offset or have had collection actions taken against you for a year you did not file a tax return.

- IRS records indicate you received wages or other income from an employer for whom you did not work.

- Extensions to file are rejected because a return with your information is already on record.

- You don’t receive expected correspondence from the IRS because the thief changed your address.

The IRS never sends unsolicited emails to consumers or contacts them by phone. And New Zealand’s IRA probably doesn’t, either. So the best thing to do is ignore the temptation to click on the link and delete the scam phishing email.

You can also report it to phishing@irs.gov and help investigators keep track of the scammers.