All posts by Barbara Nevins Taylor

NJ Sandy Victims Get Housing Extension

More than 1,000 New Jersey residents displaced by SuperStorm Sandy can stay in emergency transitional housing until March 8, 2013. Governor Christie worked out the new arrangement with FEMA.

The Transitional Sheltering Assistance (TSA) program is mean to be short term. It places families in hotels while they work toward a longer-term housing plan.

To be eligible for FEMA Programs you must:

- Register online at www.DisasterAssistance.gov, or

- Register via smartphone or tablet by using the FEMA app or going to m.fema.gov, or

- Register by calling 800-621-FEMA (3362) (TTY 800-462-7585). For 711 or Video Relay Service (VRS), call 800-621-3362.

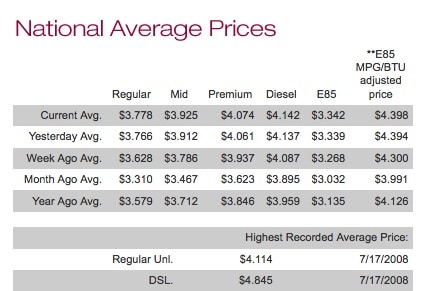

N.Y. Gas Gouging Hotline

If you drive, you know that gas prices are maddeningly moving upward again. This chart from AAA and Wright Express shows what gas costs us. There’s plenty of argument about whether oil speculators are partially to blame for the inflated prices. But the bottom line is that we are paying more, and New York Governor Andrew Cuomo wants to protect consumers at ground level. He’s set up a hotline for complaints about gas gouging and illegal practices by gas stations. If you think a gas station is taking advantage, call the New York State Hotline: 1-800-214-4372, or file a complaint http://www.dos.ny.gov/consumerprotection/consumer_resources/gas_gouging.html

Mortgage Delinquency And Foreclosure Maps

The Mortgage Bankers Association‘s (MBA) maps paint a stark portrait of where the foreclosure and late payment problems are now. Yet, there is good news from the MBA. In most areas of the country homeowners apparently find it easier to make mortgage payments and aren’t falling behind.

The group’s Chief Economist and Senior Vice President of Research Jay Brinkmann said, “The 30 day delinquency rate decreased 21 basis points to its lowest level since mid-2007. With fewer new delinquencies, the foreclosure start rate and foreclosure inventory rates continue to fall and are at their lowest levels since 2007 and 2008 respectively,”

On the other hand, SuperStorm Sandy continues to take a toll in New York, New Jersey and Connecticut where there was an increase in late payments and foreclosures. Still the outlook is good in these states according to MBA’s Brinkmann, “We expect to see improvements in these states as we move into 2013,” he said.

Reason Not To Cut Social Security Benefits

Robocaller Out Of The Game

We’re on the Do Not Call Registry list and yet the phone rings all day with robocallers offering to lower credit card interest rates, or some other thing that we don’t need. We’ve got caller I.D. and don’t pick up the phone, but it is maddening anyway.

So it’s a relief to know that one robocaller is out of the game. The Federal Trade Commission reached a settlement with Roy M. Cox, Jr. who allegedly was behind robocalls for credit interest rate reductions, vehicle warranties, and home security systems.

Cox didn’t admit that he broke the law. But the settlement bans him from telemarketing. The FTC also slapped him with a $1.1 million fine, which he won’t have to pay because according to the FTC, he doesn’t have the money.

Let’s see how long he stays away. In the meantime, the Federal Trade Commission produced a video that offers 5 tips for blocking robocalls. It’s hard to say that they are all perfect, but they do offer some defense against a really insidious practice.

Robocalls are more than simple annoyances. The people behind them often sell scams that seem attractive at the moment and it’s difficult for many of us to resist the temptation.

It’s far better to try to block the calls and prevent these fast talking scammers from wiggling their way into our wallets.

Immigrants Path To Citizenship

by Tanvir Toy

Reports of President Obama’s immigration plan concern me. U.S. A. Today and the New York Times report that a plan floated by the administration would require undocumented immigrants to wait on line for 8 years to apply for their green cards. The proposal does shorten the path for young people brought here brought by their parents. And that’s a good start.

Immigrants Under One Umbrella

But the bad thing is that the plan we’re reading about puts all immigrants under one umbrella which is not fair. There are many undocumented immigrants who have been in this country for years, speak English, pay their taxes, maintain steady jobs, and may I add, do not take any hand outs from the government. They will be grouped together with all other undocumented immigrants. They’ll have to wait eight years just to apply for their green cards and then wait five more years to become citizens. Thirteen years or more. Come on.

Create a Better Path to Citizenship

We might not have the resources to look at 11 million people on a case to case basis, but I’m sure we can come up with something better. Undocumented immigrants have been waiting for years, some as long as 20 years. Don’t make them wait longer.

I’m not an expert but I am one of the millions who wants to be legal, work, earn as much money as I can contribute to the U.S. economy and my community. I want my family members, who have worked in this country and paid taxes and never broken a law to qualify for a green card. That will allow them to work legally, get on the road to citizenship and travel outside of the U.S. to see family members. Maybe a better path to citizenship would allow the people who have been here a certain time to get their green card before the recent arrivals.

I think I speak for many undocumented immigrants when I say, shorten the time for a green card. Undocumented immigrants are willing to pay fines, back taxes, not take welfare. But please don’t pile more years of waiting on what we’ve already endured.

Let us know what you think.

How To Apply For Deferred Action

Immigration attorney Ryan Muennich walks you through the application process for the U.S. Deferred Action Program for Childhood Arrivals program. He says in many cases you don’t need to pay a lawyer to fill out the paperwork for. Ryan also warns that you must follow all of the rules after you make yourself known to immigration authorities. That means you have to update them about where you live.

Deferred Action. You only need to get legal assistance from a qualified immigration attorney if you have a problem. Ryan tells you the circumstances in which you do need help in Dream Act Immigrants- Apply Without a Lawyer.

You are eligible if you were under 31-years-old as of June 15, 2012, came to the U.S. before you were 16, continuously lived in the U.S. since June 15, 2007, were physically present in the U.S. on June 15, 2012, your visa expired, you’re in school, graduated from high school, or have a GED and haven’t been convicted of a felony or a significant misdemeanor and are not a threat to the U.S.

HERE ARE THE STEPS TO TAKE

- Log on to U.S.C.I.S website. Read the guidelines and instructions.

- Go to the side of the panel and click on form I821D. You’ll have to download it and the instructions. Again, read the instructions carefully before you fill out the form.

- Fill out the form and sign it.

- Download the form I-765. This is the application for the work permit or Employment Authorization. It will ask the basis for the application. In other words, they want know why you should get a work permit. The basis is the Deferred Action Program for Childhood Arrivals. So be sure to put that in when you fill out the form. Attach this form to the I821D form.

- Download the form I-765WS. It’s the worksheet that will accompany the other two forms. This will ask about your income and your assets. It will also ask you to list the reasons that you are requesting the work permit. Again, your reason is the Deferred Action Program for Childhood Arrivals and your plan to get a job as soon as possible.

- You’ll need 2 passport photos. You can do this at a neighborhood shop, or through one of the online services. Write your name and your alien receipt number on the back of each photos. Attach the photos to the forms.

- Make sure you collect all of your documentation:

a. You need proof that you are under 31-years old as of June 15, 2012-your passport or school records.

b. You need proof that you came to the U.S. before you were 16-your passport, Visa or school records.

c. You need proof that your Visa expired-a copy of your Visa.

d. You need to show that you are in school- report cards, transcripts work. If you graduated, make a copy of your diploma and attach it. If you earned a G.E.D., make a copy of the certificate and attach it

.e. To show that you lived in the U.S. continuously since June 15, 2007, you need school documents, credit card receipts, paid bills, or other official documents.

f. To show that you were in the U.S. on June 15, 2012, you need credit card receipts, school documents, or other official papers.

Again, make sure that you have answered all of the questions with the documentation. More is better than less.

- Write a check, or get a money order made out to the U.S. Department of Homeland Security for $465.

- Put all of the forms, photos and documentation together with the check. Mail the package to the address that’s listed for your region on the forms.

- You should receive a receipt in less than month.

- Be patient. The next step could take four to six months, although people report quicker action.

You can download all of this information in Facts To Go-Deferred Action

Dreamers Deferred- Action Approvals

Carnival Triumph-Class Action Lawsuit?

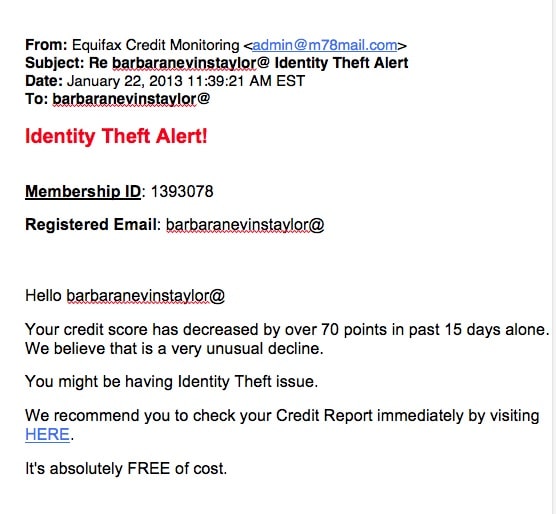

Ignore This Identity Theft Alert

by Barbara Nevins Taylor

An “Identity Theft Alert,” from something called Equifax Credit Monitoring wormed its way into my inbox recently. And I admit it made me look twice. First of all, it told me my credit score had decreased by 70 points in the past 15 days. But I knew it wasn’t true because I hadn’t done anything to lower my score. Yet, the scammers are clever. The email suggested I might have an Identity Theft issue and recommended I click HERE to check my credit report. Oh, and it was “Free,” too.

That irritated me. I don’t click links, or follow instructions from unsolicited emails. I checked the sender box again. Equifax is one of the credit reporting agencies that collects financial data and creates reports But the company doesn’t use “credit monitoring” in its name.

I sent the email to Equifax and got a quick response from spokeswoman Michele Cadac-Jones. She said, “I can confirm that the email you received did not come from Equifax and is indeed a phishing email scam. The Equifax Security and Operations teams are now aware of this and are in process of investigating it.”

Since then, I received two more emails just like the first. So beware and ignore this identity theft alert. Erase it and do not click on the links.

If you suspect a phishing email scam, the Federal Trade Commission recommends the following:

1. Don’t reply, and don’t click on links or call phone numbers provided in the message These messages direct you to spoof sites – sites that look real but whose purpose is to steal your information so a scammer can run up bills or commit crimes in your name.2

2. Area codes can mislead, too. Some scammers ask you to call a phone number to update your account or access a “refund.” But a local area code doesn’t guarantee the caller is local.

3. If you’re concerned about your account or need to reach an organization you do business with, call the number on your financial statements or on the back of your credit card.

New Mortgage Rules And You

by Barbara Nevins Taylor

It will be a year until new rules to protect mortgage borrowers go into effect.The Consumer Financial Protection Bureau (CFPB) is drafting them and plans to work with lenders to make sure everyone is on the same page.

MORTGAGE RULES AND YOUR ISSUES

But in the meantime it’s a great idea to be aware of the issues that can make mortgage borrowing hellish and what these new mortgage rules will mean to you. One of the most important proposals is the Ability-to-Repay rule. Sounds like common sense. But there are people out there who are ready to talk folks into mortgages they can’t afford. That’s what happened in the lead-up to the housing crash. So the new rule will require lenders to try to make sure the borrower can make the payments.

CLASSIC STORY

I reported a TV story about a woman whose broker told her to pick out any house she wanted. She worked at department store cosmetics counter, and her husband was a New York City cab driver. They already had a house with a mortgage and planned to keep it. She found her dream home with a price tag of about $800,000. And although her family’s income was less than $75,000, somehow the mortgage was arranged. A year later, she was facing foreclosure and claimed that she was tricked.

That’s the kind of thing the new rules are supposed to prevent. Additional rules will also clamp down on low interest “teaser” interest rates that quickly jump to unaffordable levels.

The CFPB plan also calls for new rules to deal with appraisals, high cost loans and upfront fees charged to arrange mortgages.

If you are looking for a mortgage now, go slow. Ask a lot of questions, make sure everything is spelled out clearly and be certain that you understand all of the fees and details.

Our video “How to Shop for Mortgage” walks you through process. If you’re refinancing How Do I Refinance My Mortgage explains it all.

College Still Key to Success

In case you doubted it, a college education can help point you to a more successful life. That means that

despite all of the grim news about college debt, a college education is worth the money.

A new Wells Fargo study says that even though debt is a big burden, “…a college education still appears to be the surest way to economic success.” Economists found college educated workers are less likely than those without college to be unemployed and their economic prospects are brighter.

Researchers did factor in the 37 million, the New York Federal Reserve says are struggling to pay their outstanding student loan debt. And they noted that it’s taking young people longer to move out of their parents’ homes, get married and buy their own homes. But they say the overall picture remains rosier for college grads than it does for those with just a high school education.

A particularly interesting insight in this report questions the value of for-profit-colleges. It says, “…the significantly higher rate of defaults seen at for-profit institutions does little to allay concerns over whether these institutions are indeed bettering their students’ economic prospects.”

![]() How to Pay Down Your Student Loan

How to Pay Down Your Student Loan

5 Percent Of Consumers Have Credit Report Errors

It may seem tedious and you may want to put it off for another day. But it really is a smart idea to check your credit report for errors.

The Federal Trade Commission found that five percent of consumers had errors on their credit reports.

These errors downgrade your credit score and can affect the way you’re treated by bankers, insurers, car dealers, landlords and the entire financial world that uses credit reports as a measurement for your credit-worthiness.

Three private companies, Experian, TransUnion and Equifax collect information and create separate credit reports. You can view those reports for FREE three times a year at annualcreditreport.com

“These are eye-opening numbers for American consumers,” said Howard Shelanski, Director of the FTC’s Bureau of Economics. “The results of this first-of-its-kind study make it clear that consumers should check their credit reports regularly. If they don’t, they are potentially putting their pocketbooks at risk.”

ADDITIONAL FINDINGS

- One in four consumers identified errors on their credit reports that might affect their credit scores

- One in five consumers had an error that was corrected by a credit reporting agency (CRA) after it was disputed, on at least one of their three credit reports

- Four out of five consumers who filed disputes experienced some modification to their credit report

- Slightly more than one in 10 consumers saw a change in their credit score after the CRAs modified errors on their credit report

- Approximately one in 20 consumers had a maximum score change of more than 25 points and only one in 250 consumers had a maximum score change of more than 100 points.

If you find something wrong on your credit report dispute it in writing. Our video How to Fix My Credit-No Lies walks you through the process.

Happy Chinese New Year!

by Barbara Nevins Taylor

The Dragon is gone. Welcome another reptile. 2013 is the Year of the Black Snake. The Chinese say that means it’s time for discipline, steady progress and attention to detail. And according to some, Chinese custom suggests a snake in the house means good luck because they’ll always be something to eat. Maybe that’s why snake sales are up in Hong Kong according to Taipei Times.

WHAT THE SNAKE MEANS

The snake is the sixth of twelve signs in the the Chinese zodiac and while it follows the dragon, it is far less beloved and exalted. There’s conflicting information about the symbolism of the snake on a variety of Chinese websites. But we take the most positive approach here. We like what Hanban.com has to say. It calls the water snake 2013’s cosmic symbol. And they say, water snakes are good with money and seem to have plenty of it coming their way.

So the message seems to be: pay attention to detail, focus. work hard and this may be a prosperous year. Nothing wrong with that.

Grandson Scam

It sounds so appealing and because we love our family members, sometimes our emotions cloud our judgment.

The grandson scam is the latest reminder of the need to be careful about who we, or our elderly parents, trust and how we handle money.

How it Works

Scammers call and say, “Your grandson, or granddaughter is in trouble and needs money for a hospital emergency, to leave a foreign country, or to get out of jail” They suggest you wire the money via Western Union right away. Don’t do it.

The Federal Trade Commission (FTC) advises that we slow down and resist the urge to act immediately, no matter how dramatic the story.

Verify the person’s identity by asking questions that a stranger couldn’t possibly answer. It could be something particular about your grandson like, “What’s his nickname,” or “Do you know what we call him,” or, “Do you know where he was last Christmas.”

Call a phone number for your grandson, or whomever they are calling about,that you know to be genuine.

Check the story out with someone else in your family or circle of friends, even if you’ve been told to keep it a secret.

Don’t wire money — or send a check or money order by overnight delivery or courier.

Report possible fraud to the Federal Trade Commission, or by calling 1-877-FTC-HELP.

If you are concerned about taking care of your money, or how an elderly parent is managing theirs take a look at our video, Choosing Power of Attorney Tips.