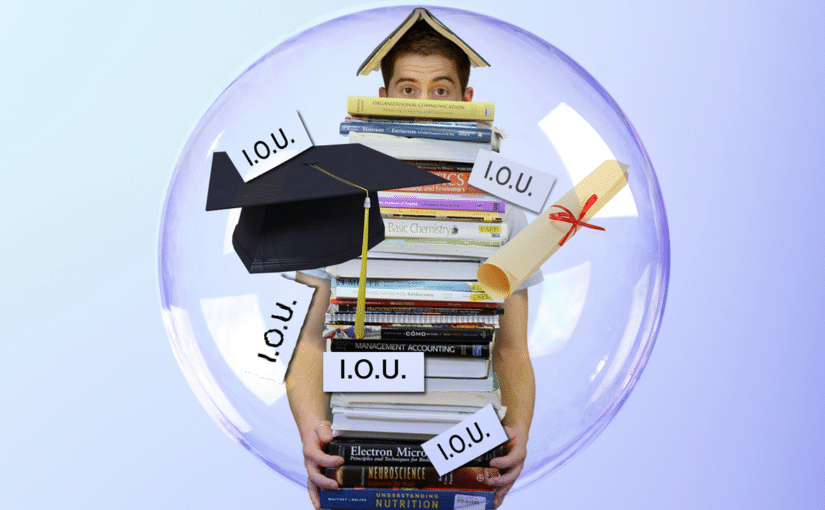

Matthew Vann investigates the best way to pay off a student loan. He comes up with a solution that is steady and sure and reduces your burden in a safe way.

The average student loan debts is more than $23,000, and most people wait until after they graduate to begin to think about paying it off.

But reporter Matthew Vann discovered that the longer you wait to start to pay down the loan, the more you’ll pay. Let’s say you take out a graduate Stafford Loan for $20,000.

$20,000 STAFFORD LOAN

6.8% INTEREST

PAY WHILE STILL IN SCHOOL-$113.00 A MONTH

PAY AFTER YOU GRADUATE -+$2,000 IN INTEREST= $230

So you more than double your monthly payment. Columbia University Financial Aid Adviser Eric Halpern says, “The way interest works on a federal loan is that it’s capitalized. If you pay off that interest early, then there’s less of a payment in the long run.” Halpern encourages students to begin to pay off the loans early, “This is going to be a huge part of their lives.

Hopefully only 10 years, but maybe even longer. So it’s not something you can put off because it’s going to affect everything you do. It’s going to affect whether you want to get a house. If you want to get a car. You’re not going to be able to get the car you want if you’re making huge monthly payments. It’s going to affect everything you do. “

TRY TO AVOID LOAN CONSOLIDATION

Many who don’t pay as they go try to manager their student loans after they graduate by consolidating them into one loan.

While this can reduce your monthly bill by 50 percent, it’s far from the perfect solution. Consolidation leads you into a deeper financial hole.

Halpern explains, “When you do consolidation it becomes a 30-year loan. And if you only pay the minimum monthly balance, you’re looking at paying almost double to triple the original loan balance.”

5 thoughts on “How To Pay Down Your Student Loan”

Comments are closed.