by Barbara Nevins Taylor

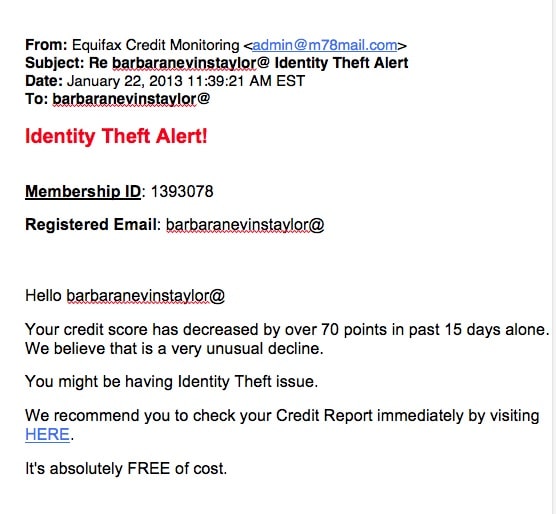

An “Identity Theft Alert,” from something called Equifax Credit Monitoring wormed its way into my inbox recently. And I admit it made me look twice. First of all, it told me my credit score had decreased by 70 points in the past 15 days. But I knew it wasn’t true because I hadn’t done anything to lower my score. Yet, the scammers are clever. The email suggested I might have an Identity Theft issue and recommended I click HERE to check my credit report. Oh, and it was “Free,” too.

That irritated me. I don’t click links, or follow instructions from unsolicited emails. I checked the sender box again. Equifax is one of the credit reporting agencies that collects financial data and creates reports But the company doesn’t use “credit monitoring” in its name.

I sent the email to Equifax and got a quick response from spokeswoman Michele Cadac-Jones. She said, “I can confirm that the email you received did not come from Equifax and is indeed a phishing email scam. The Equifax Security and Operations teams are now aware of this and are in process of investigating it.”

Since then, I received two more emails just like the first. So beware and ignore this identity theft alert. Erase it and do not click on the links.

If you suspect a phishing email scam, the Federal Trade Commission recommends the following:

1. Don’t reply, and don’t click on links or call phone numbers provided in the message These messages direct you to spoof sites – sites that look real but whose purpose is to steal your information so a scammer can run up bills or commit crimes in your name.2

2. Area codes can mislead, too. Some scammers ask you to call a phone number to update your account or access a “refund.” But a local area code doesn’t guarantee the caller is local.

3. If you’re concerned about your account or need to reach an organization you do business with, call the number on your financial statements or on the back of your credit card.