If you are among the nearly 15 million people enrolled in a Medicare Advantage plan, you might want to take a look at that booklet they sent you about rates going up in 2014. Yes, it is a pain in the neck. Yes, it is probably more than you want to do. But you may save money if you’re willing to review your plan.

RATES GO UP In 2014

Researchers at the Kaiser Family Foundation discovered that Medicare Advantage monthly premiums will rise about 14 percent in 2014. Most people who remain in the plans they have now will pay about $5 more a month and their rates will go up to a little over $39.

In addition, five percent of those who now use Medicare Advantage will find their existing plans won’t exist in 2014. Other than the pain in the neck factor, there’s not much to worry about because there is still a wide range of Medicare Advantage plans to choose from. New Advantage plans are likely to be offered by your current company.

OUT-OF-POCKET EXPENSES

Check the 2014 rates for the limit on out-of-pocket spending. Limits will go up about 11 percent, or about $600, from $4,333 in 2013 to $4,797 in 2014.

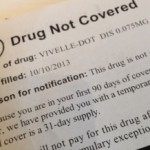

PART D PRESCRIPTION DRUG PLAN

If you’re in an HMO your prescription drug rate will increase about 13 percent to $30.50

Local PPO rates will go up a little more than $8 to $63.96 in 2014.

Those in PFFS plans will see an increase of more almost $11 to $66 in 2014.

And in regional PPOs the increase will be about $7.66 per bringing the monthly cost to about $36.14 in 2014.

HOW TO SAVE MONEY

You may save money if you switch plans. So it’s a good idea to compare what’s offered in your area. On average, most of us have about 18 private Medicare Advantage plans to choose from. And because they are offered by a range of private insurers, the rates are different.

![]() How I Found The Right Medicare Part D Plan

How I Found The Right Medicare Part D Plan

In some cases after they call they send an email with the fake claim that you owe money.

In some cases after they call they send an email with the fake claim that you owe money.

The

The

“We’re both going to retire in two years or so. I will have a small pension from the Feds and Irene will have a small pension from a previous job.

“We’re both going to retire in two years or so. I will have a small pension from the Feds and Irene will have a small pension from a previous job.