updated September 17, 2017

Anyone worried about a stolen credit card, or credit compromised in any way, should take action immediately. You can do this yourself for free.

We made that suggestion to Melissa who has an all too familiar story. She’s shy about using her real name, but what she told us shows how easy it is to become a victim of credit card fraud.

After she ate lunch at the bar in a popular chain restaurant in Brooklyn, she paid with her Chase Visa card. The bartender took it and swiped it. Everything seemed okay.

But two days later, Melissa received an email from Chase alerting her about fraudulent activity on her account. The restaurant was the only place she used the card in that two-day period. She remembered that she left her credit card receipt on the bar, and thought maybe that’s how someone got her credit card information.

Melissa was upset because she likes the restaurant and she also worried about the effect on her credit. “I was scared. I wondered about a lot of things. How did it happen? How much did the person charge on my account, and how will it affect my credit rating?

In the email, Chase told her the bank was closing the credit card account and promised to sent her a new card with a different account number.

Melissa called Chase to follow-up, but she was still left with questions about the effect on her credit score.

“How do I find out if someone used my credit card?”Melissa asked ConsumerMojo.

We suggested that she review her credit report immediately to see if there is any fraudulent spillover, and if anyone opened an account using her information.

Do this immediately.

GO TO ANNUALCREDITREPORT.COM

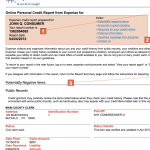

You can get a free copy of your credit report three times a year by going to AnnualCreditReport.com. Do not pay anyone to pull your credit report. You can do this by yourself.

A federal law says that three credit reporting bureaus — Experian, TransUnion and Equifax — must make your credit report available to you. They teamed up to create AnnualCreditReport.com. Avoid other websites that promise to get your credit report.

We wrote this post before the Equifax data breach that compromised the credit reports of 143 million people and as a result of that hack you may have trouble getting your credit report online. So you may also want to read Why Your Credit Report May Not Be Available Online.

You can also write and request a copy:

Annual Credit Report Request ServiceP.O. Box 105281

Atlanta, GA 30348-5281

WHY SHOULD YOU CHECK YOUR CREDIT REPORT ROUTINELY?

It’s important to thoroughly review your credit report because prospective employers look at it, lenders look at it and many landlords use credit reports before they decide to rent to you. You also want to examine the report to:

- See where you stand.

- Make sure no one has opened accounts in your name.

- Make sure the information on your credit report is accurate.

WHAT’S ON YOUR CREDIT REPORT?

- Your credit report is a history of your financial life. It has your bill paying history. It lists and shows:

- The credit cards you have, and your payment record.

- The loans you have, or had, and your loan payment history.

- Your mortgage and your mortgage payments.

- Student loans you have or had, and the way you repay them.

- Judgments or liens against you.

- Alimony or child support payments and how you pay.

- Money you may owe a doctor or healthcare provider.

- Money you may owe a hospital.

- Your outstanding parking ticket fines.

- Whether you’ve been sued.

- Whether you’ve been arrested.

The list will include all of your debts and financial activity and anything to do with your money. It is unlikely to include local retailers, gasoline credit card companies and landlords with just one or two properties.

Inaccurate Information

Credit bureaus make mistakes. If there is a mistake, you must dispute it. You do this by sending letters with proof — your cancelled checks, credit card receipts or other proof that you have paid a bill.

Experian-1-888-397-3742

TransUnion-1-800-916-8800

www.transunion.com

Equifax-1-800-685-1111

www.equifax.com

The Federal Trade Commission created a sample letter. Or, you can use our version:

SAMPLE LETTER TO CREDIT BUREAU

Date

Your Name

Your Address, City, State, Zipe Code

Complaint Department

Name of Company

Address

City, State, Zip Code

Dear Sir or Madam:

I am disputing the following information in my file. I have circled the items I dispute on the attached copy of the form that I received.

This item (s) (List the item or items you’re disputing and the name of the source such as creditors or tax court and identify the type of account- credit card or judgment, etc.) is inaccurate or incomplete. (Describe what is inaccurate or incomplete and why). I am requesting that the item be removed to correct the information.

Enclosed are copies of my documentation that support my position. (Describe what you enclose: receipts, payment stubs, court records, etc.)

Please reinvestigate this matter (or these matters), and correct or delete the information as soon as possible.

Sincerely,

Your Name

Enclosures: List all the documents that you are enclosing.

Do not send originals. Send copies and keep a copy of your letter.

Send the same letter to the creditor with the same documentation. Send both by certified mail and keep your receipt.

CREDIT REPORTING COMPANIES MUST INVESTIGATE

Credit reporting companies must investigate within 30 days of receiving your letter. They also must send your dispute and your information to the company or organization involved. That company is required to investigate and report back to the credit bureau. If they find that you are right, the information must be corrected on your credit reports by all three reporting companies.

The credit reporting companies must give you the results in writing and a free copy of your updated credit report. This doesn’t count as one of the three free annual credit reports.

If there was an error, you can ask the credit reporting company to send a letter to companies or individuals who received a copy of your credit reporting within the previous six months.

If a company refuses to correct what you claim is an error, you can request that credit reporting bureau keep a copy of your statement in your file.

Theoretically, this should work. But many people have a great deal of trouble getting inaccurate negative information removed. If you have a problem, file a complaint with the Consumer Financial Protection Bureau (CFPB). It is actively investigating the way credit bureaus keep their files and handle complaints.

HOW LONG DOES IT TAKE TO IMPROVE YOUR CREDIT?

Your credit gets better as you pay your bills. But if it is really bad, it will take seven years of regular on-time payments to clean everything up.

If you had a bankruptcy, it will take ten years to clear your record.

YOUR CREDIT SCORE

What’s on your credit report is reflected in your credit score. Most banks and lenders use the FICO Score created by a private company called Fair Isaac Corporation. It developed a formula, or formulas for calculating your credit worthiness based upon the following.

35 percent based on your payment history.

35 percent based on your payment history.

30 percent based on the amount you owe.

15 percent length of credit history.

10 percent new cards.

10 percent types of credit.

FICO TIPS:

- Apply for and open credit accounts if you really need them.

- Don’t open accounts just to have a new card.

- Closing a credit card won’t make the debt go away.

In fact, if you close a credit card it’s likely to factor as a negative in your score. If you clear your bill and don’t ever use it, that may be a problem too. So it’s probably a good idea to pay one bill with it, and keep it in a drawer the rest of the time.

![]()

3 Tips to Manage Credit Card Debt

Also when you use your credit card, make sure that you don’t exceed 50 percent of the limit. If you go beyond 50 percent, bankers advise that you split the debt between two credit cards. That it is likely to improve your credit score. HOW TO HANDLE OUTSTANDING DEBT

HOW TO HANDLE OUTSTANDING DEBT

If you want to pay your bills but can’t make the monthly payments, NEGOTIATE.

A company will write off your debt after 180 days, but it is still held against you and you will still have to pay.

The company would rather have your money than write off the debt. It’s better for you, and them, if you negotiate.

Here’s what to do:

Call the customer service number on the back of the bill.

Be very polite.

Say that you would like to set up a payment plan.

See if you can negotiate a sum that you can actually afford.

If the person on the other end of the phone won’t help you, ask to talk to supervisor.

Don’t lose your temper.

Explain what you want. You are likely to get it.

If you don’t, go right to the top to reach a decision maker. Do a Google search. Find the name of the company president and the address and write a letter explaining what you want.

You may be surprised at how successful you are.

To try to help borrowers, it analyzed complaints about servicing problems and found the auto-default provision in loans is a big problem. It studied the current practices and in a new report, the bureau asks lenders to review the default process. It also recommends changes lenders might make.

To try to help borrowers, it analyzed complaints about servicing problems and found the auto-default provision in loans is a big problem. It studied the current practices and in a new report, the bureau asks lenders to review the default process. It also recommends changes lenders might make.

Former University of Florida golfer Bob Jewett, now a Level III-certified instructor in his late sixties, says, “We guys never grow up and we never lose the desire to compete, and most of us are happier than ever.

Former University of Florida golfer Bob Jewett, now a Level III-certified instructor in his late sixties, says, “We guys never grow up and we never lose the desire to compete, and most of us are happier than ever. They feel the same way at

They feel the same way at  The

The