You may ask yourself, why take credit monitoring in the Equifax settlement rather than the $125 that was initially announced. Just get the $125, right? It turns out there isn’t enough money set aside to pay the full amount to the 147 million people affected by the 2017 data breach.

Bottom line: you’re not likely to get close to that amount.

Millions of people visited the Equifax claims website after the settlement was announced in July. And the Federal Trade Commission, (FTC) on its website, now cautions:

“Because the total amount available for these alternative payments is $31 million, each person who takes the money option is going to get a very small amount. Nowhere near the $125 they could have gotten if there hadn’t been such an enormous number of claims filed.”

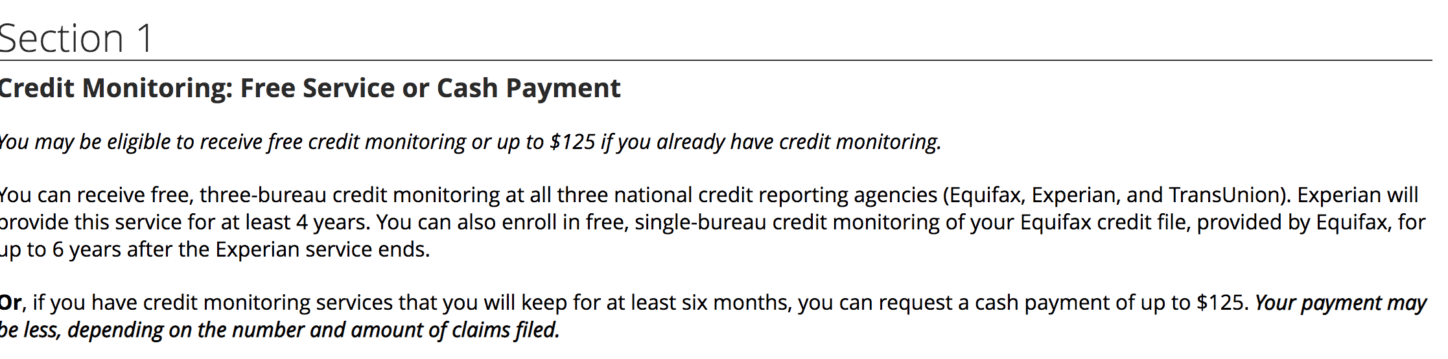

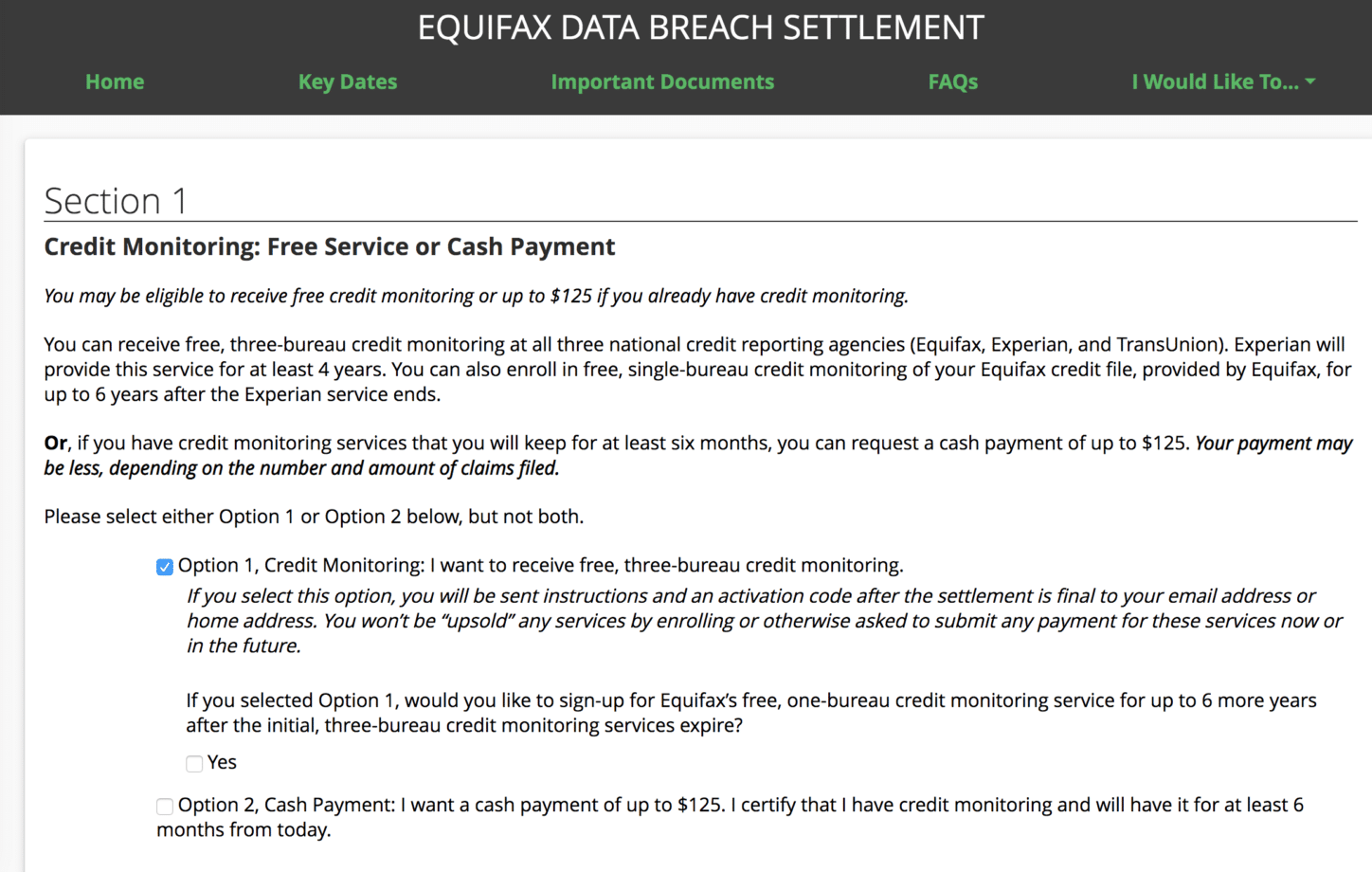

Instead the FTC says, “The free credit monitoring provides a much better value, and everyone whose information was exposed can take advantage of it. If your information was exposed in the data breach, and you file a valid claim before the deadline, you are guaranteed at least four years of free monitoring at all three credit bureaus (Equifax, Experian, and TransUnion) and $1,000,000 of identity theft insurance, among other benefits. The market value of this product is hundreds of dollars per year.”

You must file a claim by January 20, 2020

So just in case you need a refresher on how all this came about:

In 2017 hackers, or a hacker, allegedly used a flaw in the technical system to break into the Equifax server. They stole consumers’ Social Security numbers, dates of birth, and other private information. Equifax did not immediately report its own discovery that the information had been compromised.

As a consequence, The Federal Trade Commission, the Consumer Financial Protection Bureau (CFPB) and 48 state attorneys general, and those from Puerto Rico and Washington, D.C., sued Equifax. In a settlement in July, Equifax did not admit guilt but agreed to pay restitution or pay another company, Experian, to monitor the credit of people affected, if that’s the option they choose. It also put aside money to pay people for time lost while trying to recover money or straighten out problems caused by identity theft. And it promised to provide those affected identity theft insurance.

Equifax agreed to pay $575 million and potentially up to $700 million. But only $31 million of that will go to consumers for restitution. Another $31 million was set aside for people who spent time dealing with claims.

The National Consumer Law Center (NCLC) said affected consumers still have something to worry about. “One huge concern is the long term consequences of the Equifax breach. The settlement provides some compensation right now, but the risk of identity theft is forever because our stolen Social Security numbers can be traded by hackers in perpetuity. The time period to file a claim, at most, is four years. What happens if a consumer is the victim of ID theft in the fifth year resulting from the breach, which costs the consumer tens of thousands of dollars?”

If you choose the credit monitoring option, the burden is on you to check to make sure that no one has tried to use your credit or steal your identity. You have to request the reports and check them.

Consumer advocates say if you were affected, put a freeze on your credit report. That offers the best protection. “Congress has already made free the single most effective measure to prevent identity theft – a security freeze. Consumers affected by the Equifax breach should just freeze their credit reports if they are concerned about identity theft,” the National Consumer Law Center advised.

To file a claim for credit monitoring, restitution or payment for time and money lost, here’s what you do.

1. Go to Equifax Data Breach Settlement

2. Click on File a Claim.

3. The next page again asks you to click on file a claim or download a claim form.

4. The next page explains the options.

5. The next page asks for your name, address, phone number and email.

6. The next page gets to it and lets you choose the option you want, money or credit monitoring, and gives you a place to click if you want to submit a monetary claim for lost money, or time.

The settlement is far from perfect.

No one was prosecuted and apparently no one will go to prison for allowing the breach. An Equifax executive, Jung Ying, was sentenced to four months in prison in June 2019 for insider trading. He dumped his stock after learning of the hack before it was made public. But top executives were not prosecuted.

If you are not sure if you were affected, you can click here and use this tool.

The court has to sign off on the deal and you will not see any benefits before January 23, 2020 at the earliest.