All posts by Barbara Nevins Taylor

Student Lender Oversight

by Barbara Nevins Taylor

With $1 trillion in outstanding student loan debt, you might say it’s about time regulators got a handle on the loan industry. So it’s welcome news that the Consumer Financial Protection Bureau (CFPB) proposed a rule that will give it oversight of servicers that collect and process student loan payments for banks. These servicers also deal with delinquent loans and that’s a particular area of concern. CFPB Director Richard Cordray said, “Our rule would bring new oversight to the student loan market and help ensure that tens of millions of borrowers are not treated unfairly by their servicers.”

The CFPB found that many borrowers say as they try to repay their loans, questions to servicers often go unanswered. Many complain they can’t find out how much they owe, or even the terms of their loans. They also are often surprised by extra, unexplained fees. And some complain they get different stories about the status of their loans and repayment when they talk to different employees at the organizations. In addition, some find they get lost in telephone hell as they try to straighten out errors.

The CFPB oversight aims to protect borrowers and set clear rules for standards and practices by the servicers.

The public has 60 days to comment on the proposed rule after it’s published in the Federal Register.

Foreclosures Down, But

by Barbara Nevins Taylor

It’s a good news bad news picture for homeowners in trouble. On the plus side, 25 percent fewer property owners filed foreclosure papers in February than in February 2012, according to RealtyTrac. But the real estate reporting company says one in every 849 U.S. housing units had a foreclosure filing in February.

Foreclosures were up in New York and New Jersey, and Florida, Nevada and Illinois had the highest foreclosure rates in the nation. Miami, Orlando, Ocala, Tampa and Palm Bay Florida cities were the metro areas with the most foreclosures.

However, Darren Blomquist of RealtyTrac projects, “…the U.S. foreclosure inferno has effectively been contained and should be reduced to a slow burn in the next two years.

If you’re a homeowner in trouble, What to Do About Foreclosure on ConsumerMojo.com can help.

And if you’re in the market for foreclosures or short sales How Do I Find Foreclosures has great information.

We’ve got a lot more on ConsumerMojo.com. Let us know what you think. Like us on Facebook and Follow us on Twitter.

Bad Guy Strikes Twice

Bad guys always strike twice. That’s my experience. Caught running a scam and put out of business, they wake up one morning and start all over again. So it’s little surprise that a scammer shut down by the Federal Trade Commission in 1998 creeped back into the game again.

This one sounds like a can’t believe anyone fell for it scheme, but the FTC says Glen E. Burke and his company, American Health Associates, told consumers they had won thousands of dollars in prizes.

To collect, they had to buy vitamins for $300 to $500. But instead of money they received cheap costume jewelry, or a lithograph print. And in some cases according to the FTC, people were asked to pay more for better prizes.

The FTC says that in 1996 Burke ran a bogus investment scheme and in 1998 was involved in a phony direct-mail sweepstakes scheme. The company told consumers then that they’d won thousands, and even millions of dollars, and to collect they’d have to pay a small fee.

Those who paid the money received nothing and a federal judge in 1998 banned Burke from telemarketing and making misleading claims.

Now a federal judge in U.S. District Court in Nevada ruled Burke violated the 1998 order, froze his assets and appointed a receiver to take over the company.

The FTC says it’s trying to get money for those who were cheated. Stay tuned.

Comment. Share.

Stealing Your Money

Harp Refinancing Up

More than 1.1 million homeowners took advantage of extremely low interest rates and refinanced in 2012 through the Home Affordable Refiance Program (HARP). The Obama Administration created HARP in the wake of the housing meltdown to help homeowners whose property values had decreased. And some with big decrease were among those helped. Underwater homeowners, with homes worth less than their original mortgages, represented 18% of the HARP refinancings in December 2012.

HARP is strictly for homeowners with Freddie Mac or Fannie Mae mortgages made before May 31, 2009.

Why Freddie Mac or Fannie Mae?

In today’s mortgage universe, you borrow from a bank and then the bank often sells the mortgage to one of these financial giants. Both Fannie Mae and Freddie Mac were taken over by the government in 2008. While the government intends to phase them out, the agencies are supposed to be a backstop for banks and homeowners now. By buying mortgages Freddie Mac and Fannie Mae say they provide banks with cash and help homeowners get lower interest rates.

A report from the Federal Housing Finance Agency (FHFA) says California (301,327), Florida (175,686), Illinois (147,252), Michigan (144,709) and Arizona (106,387) are the top five states for HARP refinancing since 2009.

You can find out if your mortgage is owned by Fannie Mae by clicking on this link http://knowyouroptions.com/loanlookup, and if it’s owned by Freddie Mac by clicking on this link www.freddiemac.com/my-mortgage.

Don’t Pay for Help

You don’t have to pay anyone to get a Harp loan. A mortgage lender can help you.

We’ve got a lot more good stuff here on ConsumerMojo.com including How Do I Refinance My Mortgage?

Like us on Facebook and Follow us on Twitter.

Military Financial Aid Cut

Medical Alert Harassment

As if getting old isn’t tough enough, a Brooklyn company allegedly deceived, threatened and intimated elderly people to get them to buy medical alert systems. That’s why the Federal Trade Commission (FTC) sued Instant Response Systems, also known as Medical Alert Services, and a federal judge temporarily shut them down.

The FTC charges that telemarketers for Instant Response Systems called elderly consumers and pressured them to buy a pendant that supposedly allows them to get help during emergencies. In many cases, the company claimed people who never ordered the “system” owed them money.

The complaint filed in the U.S. District Court for the Eastern District of New York alleges that the company shipped medical alert pendants to consumers that they didn’t order, along with bogus invoices. It says the company “…has repeatedly threatened consumers with legal action in order to induce and coerce payment, and has subjected them to verbal abuse. In addition, the FTC contends that Instant Response Systems has illegally made numerous unsolicited calls to consumers whose phone numbers are listed on the National Do Not Call Registry.”

Consumers who tried to fight back or refuse the product were apparently unable to reach company representatives. Those who did make contact, the FTC says, faced threats and verbal abuse, and were told they had to pay.

The defendants charged in the case are Instant Response Systems, LLC, also doing business as Response Systems, B.B. Mercantile, Ltd., Medical Alert Industrial, and Medical Alert Services; and Jason Abraham, also known as Yaakov Abraham, individually and as an officer of Instant Response Systems.

This isn’t Abraham’s first brush with the law. In 2003 he was sued by the FTC for selling international “drivers’ licenses and phony university diplomas.

There is still a nagging question. Did the medical alert pendants work in the first place. We’re going to find out.

Norovirus Hits Cruise Ship

Let’s say you’re about to go on a cruise and you’ve just had stomach trouble. Would you go? Would you worry about infecting others?

We ask because a norovirus, a painful stomach ailment, ruined an 11 day cruise aboard Royal Caribbean’s Vision of the Seas.

The ship returned to Ft. Lauderdale on March 8 from the Caribbean after 105 guests and 3 crew members became ill. In a statement the cruise line said crew members gave out over-the-counter medication to those who were ill. The company said, “At Royal Caribbean International we have high health standards for all our guests and crew. During the sailing, we conduct enhanced cleaning onboard the ship, to help prevent the spread of the illness.”

After the return to Ft. Lauderdale the ship underwent another thorough cleaning, according to the cruise line. In an attempt to prevent stomach viruses from spreading, the company says it gives a letter to people when they board. Guests are asked, “…if they have experienced any gastrointestinal symptoms within the past three days.”

Did the individual, or people, who might have spread the virus read the letter? Did they answer truthfully?

We all know how popular cruises are, so how would you handle something like this?

Let us know!

Review Your Mobile Phone Bill

by Barbara Nevins Taylor

Have you reviewed your mobile phone bill lately? If you haven’t checked, you may be sorry.

It comes as a rude surprise to many of us, but sometimes mystery charges lurk, in tiny print, at the bottom of the list of legitimate fees.

Many of us end up paying for so-called “premium” services that we didn’t order and don’t want.

A new Federal Trade Commission (FTC) report highlights the widespread practice of “cramming.”

That’s what they call it when a company other than your provider adds charges to your bill. It happened to me.

For months I found a $9.99 charge for a horoscope service that I didn’t order, didn’t want and never used. It took months and repeated calls to my phone company, which had nothing to do with the charges, to get them eliminated.

The FTC asked wireless companies to make sure that customers can block third party charges, clearly spell out how to do it, and tell people how to get reimbursed. Most of the complaints filed with FTC involve charges, like mine, of under $10 for trivia, or horoscopes that are delivered via text messages.

But the game goes on, and that’s why the agency says it will host a roundtable on May 8, 2013, in Washington, D.C., to try to develop strategies to fight cramming.

In the meantime, until there’s a law, or regulation requiring some kind of cramming protection, it’s up to all of us to check mobile phone bills to make sure we’re not getting ripped off.

NY Sandy Victims Get More Time

Crackdown on Text Spam

Wouldn’t the world be a better place if all spam disappeared?

We wish it were easy to get rid of the annoying junk that crowds our inboxes. There doesn’t seem to be a quick solution, although I do wish someone would figure it out.

In the meantime, there is some consolation. The Federal Trade Commission cracked down on marketers who allegedly sent 180 million spam text messages.

The messages steered consumers to deceptive websites that falsely promising “free” gift cards. Outrageously, people often had to pay for these texts. If they responded, personal information was allegedly sold to third party marketers.

In eight complaints in courts throughout the U.S. the FTC charged 29 defendants with massive spamming. The agency explained how the scheme worked. “The messages promised consumers free gifts or prizes, including gift cards worth $1,000 to major retailers such as Best Buy, Walmart and Target. Consumers who clicked on the links in the messages found themselves caught in a confusing and elaborate process that required them to provide sensitive personal information, apply for credit or pay to subscribe to services to get the supposedly “free” cards.”

In addition, the FTC says it is pursuing a contempt action against a serial text message spammer, Phil Flora, who was barred in 2011 from sending spam text messages and who is accused of being part of this spam texting scheme as well.

Charles A. Harwood, Acting Director of the FTC’s Bureau of Consumer Protection urges, “… consumers who find spam texts on their phones, delete them, immediately. The offers are, in a word, garbage.”

Disaster Extension For NJ

New Jersey Sandy victims now have until March 22 to stay in hotels. And if you haven’t registered for disaster assistance through the Federal Emergency Management Agency (FEMA) yet, you have until April 1st to do it. This covers homeowners, renters, and businesses who want to register with the Small Business Administration (SBA) for Disaster Loan Assistance.

Governor Christie said, “This 30-day extension will help us ensure that anyone who has been affected by Sandy gets the help they need and deserve.” The governor encourages everyone eligible to register so that state officials can get an accurate picture of who needs help and what needs to be done. He also suggests that small businesses apply for a SBA Disaster Loans as soon as possible. If you change your mind you’re not obligated to accept the loan.

The Governor reminds, “Apart from the April 1 SBA Disaster Loan deadline for property damage, businesses also have until July 31 to apply for SBA economic injury disaster loans. All homeowners, renters, and businesses are encouraged to register with FEMA and SBA to ensure eligibility for future forms of aid.”

People with storm losses in all counties can register online at www.disasterassistance.gov and via smart phone or tablet here.

Survivors also can register by phone or 711/VRS by calling 800-621-3362, TTY800-462-7585.

Short Sales Up VS. Foreclosures

Chart Courtesy: RealtyTrac

While nearly one million homes in the U.S. were in some stage of foreclosure last year, it’s good news that short sales are on the rise, according to Realty Trac. This signals banks are willing to work with homeowners and buyers to reduce the price of a property below the mortgage that’s owed. A short sale is much better than a foreclosure for homeowners because it does less damage to their long-term credit rating.

RealtyTrac, follows foreclosures and its year-end report found foreclosures down 11 percent from two years ago. But foreclosures still accounted for 21 percent of U.S. residential sales and short sales represented 22 percent of home sales.

ConsumerMojo.com’s video What To Do About Foreclosure explains what you need to know if you are behind on payments and at risk of losing your home. It also explains why a short sale is a better alternative.

Download the free PDF for all the facts.

If you’re shopping for a short sale or foreclosure, ConsumerMojo.com’s video How Do I Find Foreclosures explains where to look for foreclosures and short sales and describes the process of acquiring a property this way.

Download the free PDF for all the facts.

And here is a list from RealtyTrac of the top 15 communities for buying a foreclosure from the bank.

Immigrants And Homeownership

A survey of Republicans by McLaughlin & Associates found that 66 percent of Americans support immigration reform and when told the details of a proposal by Senator Marco Rubio (R-Florida), 75 percent of those polled were for it.

Rubio’s plan sets up a pathway that would allow nearly 12 million undocumented immigrants in the U.S. an opportunity to become citizens. One of the requirements calls for them to come forward to federal authorities and be fingerprinted.

This change in attitude toward immigrants is clearly a positive acknowledgement of people who already add to our economy.

Immigrants buy into the American Dream in a big way.

A new report from the Mortgage Bankers Association (MBA) finds that immigrants accounted for the majority of growth in homeownership in New York and California from 2000-2010. Its Institute for Housing America reports 82.2 percent of those who bought homes in California were immigrants and 65.1 percent in New York. And immigrants in Illinois, New Jersey, Pennsylvania, Massachusetts, Ohio and Michigan also bought the majority of homes sold.

Professor Dowell Myers of the Population Dynamics Research Group at the University of Southern California says young immigrants, 25-34, are the most likely homebuyers because they are “… the most common age of entry to the housing market.” And the age group is growing.

According to the MBA report

- Between 2010–2020, immigrants nationwide are projected to account for 32.2 percent of the growth in all households, including 35.7 percent growth in homeowners and 26.4 percent growth in renter households

- Between 2010–2020, foreign-born ownership demand is projected to remain a majority of the growth in six states: California, New York, New Jersey, Massachusetts, Connecticut and Michigan.

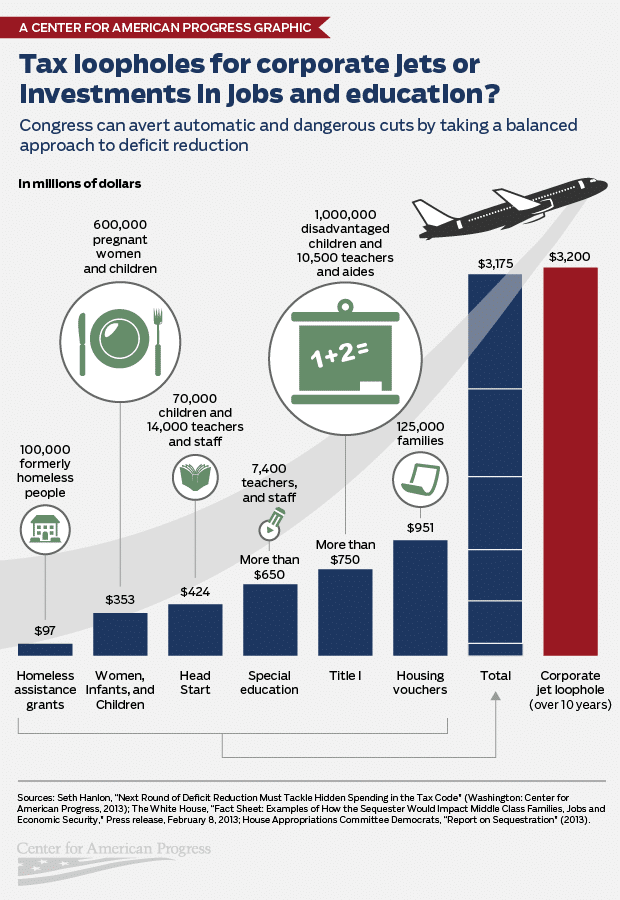

Corporate Jet Tax Loophole

Tell us why the corporate jet tax loophole is sacred.

Thanks to the Center for American Progress for creating the graphic and Organizing for Action for passing it along.