The check is set to go in the mail. That’s the message from the Office of the Comptroller of the Currency (OCC): 4.2 million borrowers, whose mortgage lenders wrongly foreclosed, or made errors in the foreclosure process, will start to get checks after April 12. This is part of the agreement reached by the OCC and the Federal Reserve Board with 13 big companies including:

Aurora, Bank of America, Citibank, Goldman Sachs, HSBC, JPMorgan Chase, MetLife Bank, Morgan Stanley, PNC, Sovereign, SunTrust, U.S. Bank, and Wells Fargo.

Cash payments

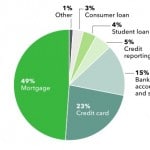

$3.6 billion in cash payments are set for borrowers whose homes were in any stage of the foreclosure process in 2009 or 2010. Individual payments will range from $300 to $125,000. There’a formula for the payments based on how far the foreclosure went and the type of error made.

Checks will be sent in several waves beginning with 1.4 million checks on April 12. The final batch will go out in mid-July 2013. Payments from Goldman Sachs and Morgan Stanley will not go out with the first wave. The OCC says it will announce dates for those payments soon.

Here’s how it will work:

In most cases, borrowers will receive a letter with an enclosed check sent by the Paying Agent—Rust Consulting, Inc. Some borrowers may receive letters from Rust requesting additional information needed to process their payments. Previously, Rust sent postcards to the 4.2 million borrowers notifying them of their eligibility to receive payment under the agreement.

Borrowers can call Rust at 1-888-952-9105 to update their contact information or to verify that they are covered by the agreement.

Beware scams and “fees”

Anyone who asks you to call a different number or to pay a fee is scam artist. Be very careful.

You can still take legal action

The OCC says, “Accepting a payment will not prevent borrowers from taking any action they may wish to pursue related to their foreclosure. Servicers are not permitted to ask borrowers to sign a waiver of any legal claims they may have against their servicer in connection with accepting payment.”

If you have question, “Ask Barbara.”

Like us on Facebook and Follow us on Twitter.