All posts by Barbara Nevins Taylor

Manhunt for Boston Bombing Suspect

FBI Suspects in Boston Bombing

Seniors Misled by Financial Advisers

The pitches are endless. They come in the mail, online and on the phone. A so-called financial expert wants to help you plan for retirement, or manage your “senior savings.” And whether you consider yourself a “senior,” some of these services and offers can, and do, lead to trouble. That’s why the Consumer Financial Protection Bureau (CFPB) is trying to set standards for those who pitch themselves as “senior advisers” to 50 million older Americans.

They often call themselves Senior Financial Analysts, Senior Financial Consultants, Senior Financial Planners, Senior Wealth Management Analysts and the list goes on. CFPB found more than 50 different titles for those who try to advise older people about financial issues.

The CFPB points out that older consumers often have higher household wealth in the form of retirement savings, inheritance, accumulated home equity, or other assets. But there are also health issues and memory deterioration that make them easy marks. Some of these so-called financial consultants work the circuit of 55 Plus communities, senior centers and assisted living facilities. The CFPB says they offer “free lunch seminars,” which they bill as education, but are really tools for selling financial products and investments.

Research and interviews with consumers and experts led to a report: “Senior Designations for Financial Advisers: Reducing Consumer Confusion and Risk.” It makes recommendations for change to Congress and the U.S. Securities and Exchange Commission.

CFPB Director Richard Cordray said, “Today’s report underscores the need for consistent high-level standards of training and conduct for those advisers who want to acquire a bona fide senior designation.”

Recommendations:

- Implementing rigorous training standards to obtain senior designations: The Bureau recommends that state and federal regulators implement rigorous criteria for acquiring senior designations, including specific standards for education, training, and accreditation.

- Setting strict standards of conduct for those using senior designations: The Bureau recommends that state and federal regulators set consistent and strict standards of conduct for those using senior designations. Such standards could include prohibiting senior designees from characterizing sales events as educational seminars, and selling financial products and services at events that are advertised or described as educational or informational events.

- Increasing supervision and enforcement: The Bureau recommends that federal and state regulators consider increasing existing supervision of and enforcement authority against misleading conduct by a holder of a senior designation.

What’s your experience?

What’s your experience? How have you dealt with people offering financial advice? Let us know.

What the Immigration Bill Does

The immigration bill is complicated and if it passes will give legal status to 11 million undocumented immigrants. That’s great because it means people will be able to work legally, get drivers’ licenses and travel out of the country. The downside is that it will take a long time, 10 years, for many to become eligible for green cards and citizenship.

But it does jumpstart the process for Dream Act kids and that’s really wonderful.

If you are a Dreamer you can get a green card in five years and will become eligible for citizenship immediately.

Details of the proposal:

1. If you are an undocumented immigrant you can apply for Registered Provisional Immigration Status if:

- You lived in the U.S. before December 31, 2011.

- Pay a $500 penalty fee. Dreamers are exempt.

- Pay back taxes.

- Pay the processing fee.

2. You’re not eligible if:

- You were convicted of a felony

- Convicted of 3 or more misdemeanors

- Convicted in another country

- Voted unlawfully

- You’re a national security or public health risk.

3. Your spouse or children can also apply under your qualifications.

4. You can get a job legally.

5. You can travel outside of the U.S.

6. Those in the U.S. prior to December 31, 2011, but deported for non-criminal reasons can apply for resident status.

7. The status lasts for 6 years and then you have to reapply and pay $500.

8. After 10 years, if you have a clean record, you can get a green card. But you must pay a $1,000 fee.

9. Dream Act immigrations and those in the Agricultural Programs get their green cards after five years. Dream Act immigrants can apply for citizenship after they get green cards.

Special Employment Visas

1. Eliminates the limit on the number of those considered extraordinary, or who have special backgrounds in sciences, the arts, medicine, business, athletics; outstanding professors and researchers; multinational executives and managers; doctoral degree holders in STEM field; and physicians who have completed the foreign residency requirements or have received a waiver.

- It allocates 40 percent of the worldwide level of employment-based visas to: 1) members of the professions holding advanced degrees or their equivalent whose services are sought in the sciences, arts, professions, or business by an employer in the United States (including certain aliens with foreign medical degrees) and 2) aliens who have earned a master’s degree or higher in a field of science, technology, engineering or mathematics from an accredited U.S. institution of higher education and have an offer of employment in a related field and the qualifying degree was earned in the five years immediately before the petition was filed.

- The bill increases the percentage of employment visas for skilled workers, professionals, and other professionals to 40 percent, maintains the percentage of employment visas for certain special immigrants to 10 percent and maintains visas for those who foster employment creation to 10 percent.

- The bill creates a startup visa for foreign entrepreneurs who seek to emigrate to the United States to start up their own companies.

- Merit Based Visa: The merit based visa, created in the fifth year after enactment, awards points to individuals based on their education, employment, length of residence in the US and other considerations. Those individuals with the most points earn the visas. Those who access the merit based pathway to earn their visa are expected to be talented individuals, individuals in our worker programs and individuals with family here. 120,000 visas will be available per year based on merit. The number would increase by 5% per year if demand exceeds supply in any year where unemployment is under 8.5%. There will be a maximum cap of 250,000 visas.

- Under one component of this merit based system the Secretary will allocate merit-based immigrant visas beginning on October 1, 2014 for employment-based visas that have been pending for three years, family-based petitions that were filed prior to enactment and have been pending for five years, long-term alien workers and other merit based immigrant workers.

- Long–term alien workers and other merit-based immigrant workers includes those who have been lawfully present in the United States for not less than ten years and who are not admitted as a W visa under section 101(a)(15)(W) of the Act.

Remember this isn’t law yet. It’s a start.

If you are a Dreamer and haven’t applied for the Deferred Action for the Childhood Arrivals Program the time is now. Our video and free downloadable guide How to Apply for Deferred Action walk you through the process.

Loan for Deferred Action Application

There is now a no interest loan for those who can afford to pay the fee for the Deferred Action application. Watch the video No Interest Loan for Deferred Action and get the details.

Big Reason to Check Your Smartphone Bill

Student Debt Cuts Home and Car Buying

Boston Marathon Charity Scams

People want to help. No doubt about it. But horrific incidents like the bombings at the Boston Marathon also spawn financial evildoers. They prey on our good instincts and our desire to contribute to help individuals, families and communities recover. The Federal Trade Commission (FTC) issued a scam alert to remind us to avoid the predators who make urgent appeals for money. You may get phone calls, emails or text messages. Invariably, these appeals result in donations that help only to enrich the scam artists.

Here’s the FTC’s advice:

- Donate to charities you know and trust. Be alert for charities that seem to have sprung up overnight in connection with current events, like the bombing.

- Ask if a caller is a paid fundraiser, who they work for, and what percentage of your donation goes to the charity and to the fundraiser. If you don’t get a clear answer — or if you don’t like the answer you get — consider donating to a different organization.

- Don’t give out personal or financial information — including your credit card or bank account number — unless you know the charity is reputable.

- Never send cash: you can’t be sure the organization will receive your donation, and you won’t have a record for tax purposes.

- Check out the charity with the Better Business Bureau’s (BBB) Wise Giving Alliance, Charity Watch, or GuideStar.

- Find out if the charity or fundraiser must be registered in your state by contacting the National Association of State Charity Officials.

Have you been contacted by someone asking for money? Share your experience with us.

Like us on Facebook and Follow us on Twitter.

Who Gets Your Social Security Number?

by Barbara Nevins Taylor

The Facebook posts sound great. There are almost 70,000 followers of one company that promotes the idea of lowering your bills through refinancing, or other things like debt consolidation, debt relief, and credit card balance transfers. So what’s the catch? Essentially these companies generate leads for other companies that will attempt to sell you financial services.

They ask for personal information including your Social Security number. And that’s a big deal.

Take care about giving out personal information

It’s just not a good idea to give out your Social Security number during a casual online exploration. You have no idea where it will end up.

About one company

LowerMyBills.com (LMB) is the primary company using this business model. It was owned by Experian until October 2012. A California-based company called Core Digital Media bought it in October 2012.

Mitch Viner, Director of Operations for LowerMyBills.com, told ConsumerMojo that you don’t have to give your Social Security number to be referred to lenders. But he says those who do provide Social Security numbers are considered “Premier leads.”

Why ask for a Social Security Number?

Viner explains,”The purpose of collecting SSN is to validate consumer-supplied information, and help cut down on false submissions or identity theft. We also believe it shows a higher-intentioned consumer. Again, this is a secondary option, and not required for the use of the matching service”

You are a “Lead”

Remember, you are a lead. You are not their client. Their clients are lenders and others to whom they sell the information.

Viner says, “The contract with LMB requires that the institution be a licensed financial institution and/or bank. The institution must pass a Premier-verification check, which includes credit check, license verification with state agencies, and appropriate contract obligations (including warranty as to compliance with law, data security, no use or resale without consumer consent, no “auto-pull” of credit reports without consumer authorization, etc).

He also insistes, “We do not permit the resale of SSN or Premier leads, nor do we resell any Premier leads outside of this process.”

LowerMyBills also spells out its policies online and you might want to take a look:

https://www.lowermybills.com/misc/termsofuse/index.jsp

https://www.lowermybills.com/misc/privacy/index.jsp

Bottom Line

Be very, very careful about entering those Social Security numbers online, or anywhere else.

What do you think? Let us know.

Follow us on Facebook and Like us on Twitter

Military Loans Work Loopholes In a Bad Way

by Barbara Nevins Taylor

If you’re in the military and you need money, you may be tempted by a quick cash loan. Let us suggest that you hold that thought. The attractive ads you see online and in the flashing lights of storefront windows are like the big bad wolf knocking at your door.

Stay with me for a minute. The Military Lending Act of 2007 aimed to protect military members and their families.

That law outlawed predatory payday loans for the military. It defined them as those:

1. For less than $3,000

2. For 91 days or less

3. Vehicle title loans for 181 days or less.

So how is it possible that there is such a big online business where lenders seem to speak exclusively to your club?

These lenders use the loopholes in the law. They just make the loans for a bit longer. And some of these companies charge close to 400% interest. Sure, you may need cash. But borrowing like this inevitably pulls you deeper into debt and trouble.

Tom Feltner, Director of Financial Services for the Consumer Federation of America (CFA), says, “Very high cost credit options don’t just make it difficult to pay at the next payday. There are long-term security and employment issues that are affected when you end up deeply mired in debt.”

The Department of Defense (DOD) considers this kind of lending risky for individuals and military readiness. A 2006 report said, “Predatory lending undermines military readiness, harms the morale of troops and their families, and adds to the cost of fielding an all-volunteer fighting force.”

DOD repeatedly asked Congress to close the loopholes. In 2012, the Senate passed a bill that would have done that. But the House wouldn’t go along with it.

So while you are working hard to protect Congress and the rest of the nation, who is protecting you? You might ask your Congressman.

Feltner and the CFA say the time to make the change is now. “We think… we need to close the loopholes in the Military Lending Act to protect service members from high-cost abusive forms of credit that are negatively impacting security clearance, readiness and economic security.”

In the meantime, a safe bet is borrowing from a credit union. Here are few, and there are many more.

Navy Army Community Credit Union

Air Force Federal Credit Union

U.S.Coast Guard Community Credit Union

Let us hear from you. What do you think?

Follow ConsumerMojo.com on Facebook and Like us on Twitter.

Elizabeth Warren Goes After Bank Regulators

One Reason To Modify Your Mortgage

Here’s one great reason to modify your mortgage, especially if you struggle to make monthly payments. The Federal Housing Finance Agency (FHFA) directed Fannie Mae and Freddie Mac to extend the Home Affordable Refinance Program (HARP) for two years to December 31, 2015.

HARP was set up by the Obama Administration specifically to help homeowners in trouble. The program works with homeowners who are “underwater.” In other words, those who owe more than their homes are worth.

FHFA Acting Director Edward J. DeMarco says,“More than 2 million homeowners have refinanced through HARP, proving it a useful tool for reducing risk. We are extending the program so more underwater borrowers can benefit from lower interest rates.”

HARP eligibility:

- The loan must be owned or guaranteed by Fannie Mae or Freddie Mac.

- The mortgage must have been sold to Fannie Mae or Freddie Mac on or before May 31, 2009.

- The mortgage cannot have been refinanced under HARP previously unless it is a Fannie Mae loan that was refinanced under HARP from March-May, 2009.

- The current loan-to-value (LTV) ratio must be greater than 80 percent.

- The borrower must be current on their mortgage payments with no late payments in the last six months and no more than one late payment in the last 12 months

Find out if you qualify:

Contact your existing lender or any other mortgage lender offering HARP refinancing. Check to see if your loan is owned by Fannie Mae or Freddie Mac.

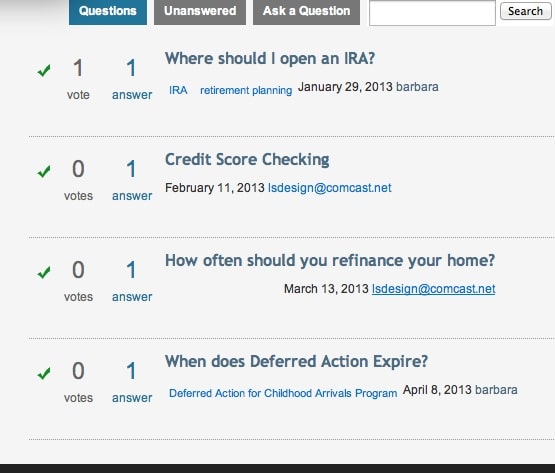

Have A Question? Ask Barbara

We just put up a new Question and Answer tool and we’re trying it out. We need your questions to see how it works.

If you have a question about credit, money, insurance, mortgages and refinancing, planning for the future, an immigration issue, a possible ripoff or scam “Ask Barbara.”

Deferred Action-How Long Can You Wait To Apply?

Watch Out For Hotel Room Wireless Charges

by Nick Taylor

“I hate hotels that charge for Internet access. Bah, Marriott.” That was friend and Southern chef extraordinaire Nathalie Dupree’s recent Facebook post from the West Coast. I couldn’t agree more.

Most hotels that cater to business travelers charge up to $15 a day for in-room wireless because they can get away with it. The Internet’s a business tool that hardly anybody can do without. So while somebody whose company is paying the bill is sitting on his bed in his underwear browsing the net, I’m in the lobby with the rest of the price-conscious travelers using the free signal for our Internet explorations. If I’m lucky I will have found a chair.

That’s the way it usually breaks down. Not all hotels are the same, obviously, and even franchisees of the same chains don’t always follow the same policies regarding Internet access. But generally, the free access is in the lobby and you have to pay for access in your room. The gearheads in the crowd may have ways to get around that, but most of us don’t.

I have some sympathy for the hotels. They’re probably using the in-room charges to pay for continually being left behind by technology. I was in a hotel in Alabama not too long ago that still had telephone and USB cables bundled in the desk drawer along with cards on how to use them. I can see children asking, “Mommy, Daddy, what are these?”

“Those are dead technologies, dear. Wash your hands. You don’t know where they’ve been.”

I’m guessing that it doesn’t cost a hotel operator that much, if any, more to provide free wireless access in its guest rooms. It sure doesn’t cost $15. It would be worth that much in goodwill for hotels to drop the charge entirely.

Of course, smartphones and tablets with phone plans obviate the need for Internet access for many travelers. But a bigger screen sometimes makes all the difference. When booking a hotel reservation, it’s a good idea to find out ahead of time how much you’ll have to pay for a wireless connection in your room.

One caveat: if you’re outside the United States and are going to spend time checking sports scores or Facebook or responding to email on your iPhone or Droid device, the cellphone roaming charges mount up quickly. That’s where a charge for wireless Internet access might be a better deal. But then, sitting in the lobby and getting a free signal would be better still.

What some hotels charge, and don’t:

Kimpton Hotels offer free wireless if you sign up for its free loyalty program.

La Quinta Hotels offer free Internet. Some provide wireless service.

Hilton Hotels charge up to $14.99 daily for wireless at some locations like the Hilton New York on Avenue of the Americas. A spokesman said the fee is less at other hotels.

HHilton Honors Diamond and Gold members receive free WiFi including at the luxury hotels including: Waldorf Astoria Hotels & Resorts, Conrad Hotels & Resorts, Hilton Hotels & Resorts, Doubletree by Hilton and Embassy Suites.

Free Internet is available to all at Hilton Garden Inn, Hampton, Homewood Suites by Hilton and Home2Suites by Hilton.

Hyatt Hotels charge $9.95-$12.95 daily. Wireless is free in Hyatt Place and Hyatt House hotels.

Marriott Hotels charge $12.95 daily unless there’s a special package.

Marriott Gold and Platinum Elite members receive free wireless.

Marriott’s Courtyard, Fairfield Inn, Residence Inn, SpringHill Suites and Town Place Suites hotels offer free in-room wireless.

Starwood Hotels, which include Sheraton, Westin, W, ALoft, Le Meridien, St.Regis, Element and the Luxury Connection generally charge between $9.95 and $14.95 daily. The W Hotels $14.95, while the Westin hotels charge $9.95. daily.

Sheraton’s Four Points Hotels offer free wireless.