Tip 2

FIND OUT ABOUT THE RULES

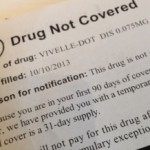

Individual insurance companies set rules that can make it difficult to get the medication that you need and want. That’s why it’s a good idea to find out exactly what an insurer will and will not cover, and exactly how the drug plan functions. If you’re like me you want to avoid as many unpleasant surprises as possible.

1. PRIOR APPROVAL

Some insurers require that you get prior approval from them before they will pay for certain drugs.

How do you know which drugs they will cover?

- Most insurers have some kind of “tool” on their website that lets you look up the medication that you want.

How do you get prior approval?

- You or your doctor will have to download a form from the insurer’s website, fill it out and submit.

2. STEP THERAPY

What’s Step Therapy?

Step therapy is the term insurance companies use when they want you to use generic drugs before you can move on to get a brand name prescription medication. This may be infuriating, but often doctors will go along with it because they don’t want to fight the insurance company every step along the way. Joe Baker of the Medicare Rights Center says, “Many times doctors will say, ‘Okay. Let’s try something else first.'” If the generic drug doesn’t work, then the you have to back to the insurer and appeal.

If you can’t live with the rules, this drug plan is not for you. There are choices and you shouldn’t settle for a Part D plan that is going to be difficult for you to deal with.