Like everything else online, you can find the wonderful, the bad and the horrible in the Internet job search world. Online companies make it easier to tap into available positions, tougher for those who do best in face-to-face situations, and perhaps even trickier, thanks to dodgy business practices, to find a good job

The Federal Trade Commission (FTC) charged Gigats.com, an education lead generator, with a kind of bait-and-switch that fooled job seekers. Gigats.com brags that it is one of the “ten fastest sites to reach one million users,” but the FTC charged it didn’t treat those users fairly.

In a complaint, the FTC said “…the company claimed it was ‘pre-screening’ job applicants for hiring employers when it was actually gathering information for other purposes, including lead generation for post-secondary schools and career training programs.”

That means Gigats.com allegedly took information that job applicants posted and sent it to schools and training programs that paid $22 to $125 for email addresses and other personal information of people looking for work.

If you did see an appealing post on the Gigats site, you might never connect with an employer. The FTC found that, “Many of the job openings were not current, and for those that were, the employers had not authorized Gigats to collect applications or screen or interview applicants. In addition, the defendants never sent the information they collected from consumers to the employers.”

Instead, the company steered job seekers to “employment specialists” who often claimed they were education advisors and recommended the schools and programs that paid for the leads.

While the FTC fined Gigats $90.2 million, it won’t collect all that money. Apparently, the company can only afford to pay a fine of $360,000.

The defendants include Expand Inc., also doing business as Gigats, EducationMatch and SoftRock Inc., and Ayman A. Difrawi, also known as Alec Difrawi and Ayman El-Difrawi.

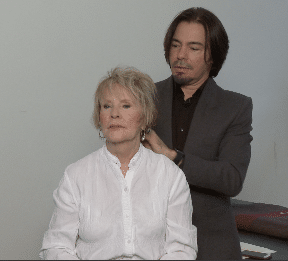

Richard Grandinetti works as a makeup artist for Trish McEvoy at Bergdorf Goodman in New York City. You can reach him @richardgrand@gmail.com.

Richard Grandinetti works as a makeup artist for Trish McEvoy at Bergdorf Goodman in New York City. You can reach him @richardgrand@gmail.com.