by Barbara Nevins Taylor

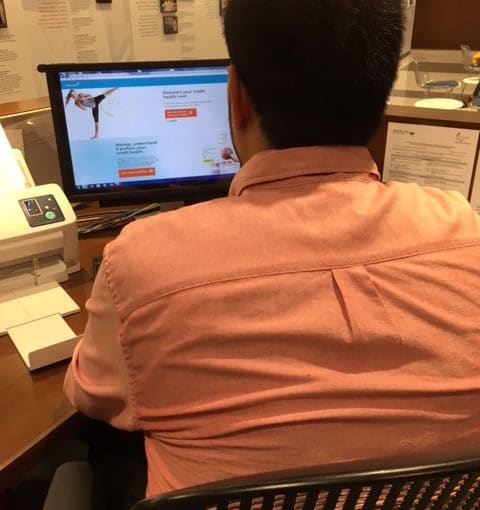

Somewhere out there a credit repair company may exist that actually does the job. But all of those I’ve encountered seem ready to charge you fees and add to the debt you already owe. So why waste money on a credit repair company?

The latest example of why credit repair companies may not help at all comes from the Consumer Financial Protection Bureau (CFPB). It sued a national, California-based, credit repair operation whose tactics seem to come straight from the playbook of other rip-off artists.

The CFP alleges that Prime Market Holdings, also known as Park View Credit, National Credit Advisors, and Credit Experts, broke the law by charging fees in advance, misleading people about what they could actually do, and misleading consumers about the benefits of the service.

Telemarketers from the company called consumers who filled out online loan applications having nothing to do with credit repair. They also contacted people who responded to their web ads for credit repair services, according to a lawsuit filed in United States District Court in central California.

To get help, consumers had to pay a fee for consultation or for a credit report. (You can get a free credit report online three times a year at annualcreditreport.com). But the illegality comes from charging an upfront fee before you actually help someone repair their credit.

Consumers who paid the fee and signed a contract found themselves billed $89 a month for services that didn’t accomplish what the company claimed, according to the complaint.

Many did not know they would face a monthly charge and that the company set a time limit for cancelling the contract.

In addition, Prime Market Holdings could not, as it claimed, remove all negative information from credit reports nor could it raise credit scores by more than 100 points in all cases.

The CFPB asked the court to stop Prime Market Holdings and its companies from doing business and to refund consumers’ money.

We’ve seen this before. The company gets sued and the owners often turn up doing the same thing again using a different corporate name.

WATCH OUT FOR SCAMMERS

While it may have a better ending this time, others out there play the same game that’s ultimately dangerous for consumers. So take care before you respond to a radio ad, an online come-on or any other promise that a company or individual can help you repair your credit for a fee.

Susan Shin from the New Economy Project (once called NEDAP) recorded this warning for us.

WHAT’S ON YOUR CREDIT REPORT?

WHAT’S ON YOUR CREDIT REPORT?