updated October 7, 2017

by Barbara Nevins Taylor

You heard and read about the data hack. Now what should you do to protect yourself after the Equifax breach? The theft affects millions of us in a bad way. We have no clue exactly how yet but you can find out if hackers got your personal information. I went on to the Equifax site and discovered hackers got mine. And we’ll explain how you can find out about whether the hack affects you and what to do.

It could. Hackers gained access to the accounts of 143 million people, that’s what Equifax said at first. After an investigation by outside forensic experts, the company upped the number affected to 145.5 million people in the United States.

The data hack makes three-quarters of consumers with credit reports prime targets for identity theft.

In a news release, Equifax said it discovered the hack on July 29, 2017 and we and other consumer advocates wonder why they waited so long to let us know.

The company acknowledged the information stolen includes “. . . names, Social Security numbers, birth dates, addresses and, in some instances, driver’s license numbers. In addition, credit card numbers for approximately 209,000 U.S. consumers, and certain dispute documents with personal identifying information for approximately 182,000 U.S. consumers, were accessed. As part of its investigation of this application vulnerability, Equifax also identified unauthorized access to limited personal information for certain UK and Canadian residents.”

Next Step

Go to the website Equifax set up for this crisis: https://www.equifaxsecurity2017.com/

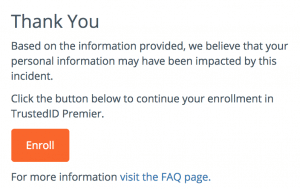

They ask for your name and the last six digits of your social security number. Based on that, you’ll learn immediately whether hackers may have stolen your information.

Then push the “Enroll” button that takes you to the page for the “TrustedID Premier” program.”

Once you register, Equifax will offer free services for an unlimited time. Initially they promised a year, but consumer outrage forced the change.

- Credit monitoring of Equifax, Experian and TransUnion credit reports

- Copies of Equifax credit reports

- Give you the ability to lock and unlock Equifax credit reports

- Identity theft insurance up to $1 million.

- Internet scanning for Social Security numbers

But the National Consumer Law Center (NCLC) says Equifax doesn’t go far enough: “Consumers need the ability to “lock down” or freeze their credit reports at all three major credit bureaus, and for more than one year, because the stolen information could still be used to fraudulently apply for credit using a report from Experian or TransUnion as well.”

The NCLC, the U.S. Public Interest Group (USPIRG) and other advocates also demanded Equifax change its forced arbitration plan, which prevented consumers affected by the hack to sue, or join a class action lawsuit.

What should you do about the Equifax data hack now?

But both consumer groups suggest strongly that anyone harmed by the Equifax breach get security freezes immediately at Equifax, TransUnion and Experian.

This means that no loans, credit or services will get approved in your name without your approval. Depending upon your state and age, the credit bureaus offer it free, or charge $5 – $10.

If you don’t want to do that, put a 90-day “initial fraud alert” in your credit report that tells businesses they should verify your identity before they issue credit. You have to renew an “initial fraud alert” every 90 days.