You look at your checking account and you find money, a loan, you never asked for and a series of unauthorized debits. Sounds crazy, but it happened to people who explored the possibility, online, of getting a payday loan but stopped short of actually applying for one.

The Consumer Financial Protection Bureau (CFPB) filed a lawsuit in Federal District Court in the Western District of Missouri to shut down the payday lender at the heart of the scheme.

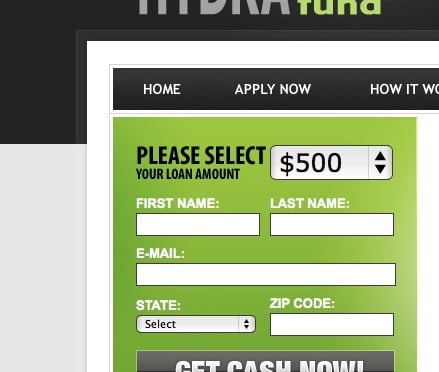

The CFPB alleges that the Hydra Group used lead generators, online sites, that offer to help get you a payday loan. They allegedly gobbled up your banking information and gave you a loan whether or not you wanted it.

The CFPB says the company used falsified loan documents to make it seem as though people agreed to the loans.

CFPB Director Richard Cordray said, “The Hydra Group has been running a brazen and illegal cash-grab scam, taking money from consumers’ bank accounts without their consent. The utter disregard for the law shown by the Hydra Group and the men controlling it is shocking, and we are taking decisive action to prevent any more consumers from being harmed.”

The CFPB’s lawsuit says Richard F. Moseley, Sr., Richard F. Moseley, Jr., and Christopher J. Randazzo operate the business through about 20 companies including SSM Group, Hydra Financial Limited Funds, PCMO Services, and Piggycash Online Holdings. While the companies are based in Kansas City, Missouri, many are incorporated offshore, in New Zealand or the Commonwealth of St. Kitts and Nevis.

Apparently some consumers did sign up for loans, although most did not. The CFPB alleges that during a 15-month period, the Hydra Group made $97.3 million in payday loans and collected $115.4 million from consumers.

The CFPB investigation found that the company typically deposited $200 to $300 in a bank account and then withdrew a $60 to $90 “finance charge” every two weeks indefinitely. The lawsuit says some people used stop-payment orders or closed their bank accounts to halt the bi-weekly debits.

The CFPB lawsuit aims to stop what it calls “the Hydra Group’s illegal business.” It also hopes to get money back for consumers.

Stay tuned.

Comment. Tell us what you think