updated December 28, 2017

Pay taxes for 2018? Who wants to think about that in the middle of the holiday glow? But the Trump-Republican tax overhaul threatens to hurt us and millions of other middle-income people and we want to limit the damage it can inflict. So we checked in with our accountant, Jake Fine, and he advised us to make the most of the last week of December. “Pay your real estate taxes for the first two quarters of 2018 before the end of this year,” he said.

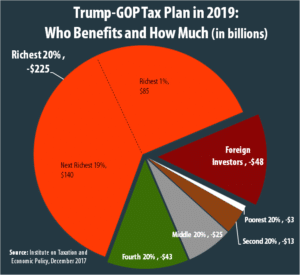

The non-partisan Institute on Taxation and Income Policy points out the tax law will benefit “high-income households and foreign investors.” The group’s analysis says, “In the first year of the plan, the richest households will receive an average tax cut of $55,000.”

It will also benefit President Trump and his family while it hurts the middle class and those of us who own a home and live in high tax cities and states.

Instead of deducting the total amount of real estate tax we pay in New York City, we can now only deduct $10,000. We pay significantly more taxes and this will really hurt us and others like us.

New York Governor Andrew Cuomo estimates the new law will increase taxes on New Yorkers by $14 billion. Cuomo issued an Executive Order instructing local governments to accept tax payments for 2018 in 2017.

Cuomo said, “As Washington wages an all-out assault on this state and this nation, I have authorized local governments to allow property owners to pay part or all of their taxes early. New York has made unprecedented progress reducing the burden of taxes on our middle-class families, and we will not allow this attack to roll back all that we have achieved. This Executive Order will allow property owners to deduct either part or the full amount of their payment from their federal taxes before the GOP tax bill goes into effect.”

The IRS issued an advisory clarifying the circumstances under which you can pre-pay your 2018 taxes in 2017 and get a deduction. Basically, you need to have an assessment and a bill from your county, town or city. So it’s likely that you have been assessed for the first two quarters of 2018, but not for the rest of the year yet. If that’s the case, the IRS advisory says, “Taxpayers who prepay their 2018-2019 property taxes in 2017 will not be allowed to deduct the prepayment on their federal tax returns because the county will not assess the property tax for the 2018-2019 tax year until July 1, 2018.”

It’s wise to check with your county or city government to see if they will accept your taxes early. It’s also a good idea to check with your accountant or financial advisor to see what you need to do to reduce the tax burden Trump and the Republicans have piled on.