If you read my last post about borrowing to pay for college, you know how much my student debt surprised me. I’m 22 years old and $22,000 in debt. Call me naive or foolish, but I thought things would be different by now. I thought that my degree would lead to a job immediately and I’d make enough money in a job in my field to pay my loans.

Millions of us wonder if college is still worth it. Do the benefits outweigh the costs? A report by the Federal Reserve Bank of New York tells us that we’re making the right choice. They say that people who earn their Associate’s or Bachelor’s degrees make 15 percent more than those who do not earn these degrees.

But with tuition rising each year and a sluggish labor market, it’s hard to feel confident about paying so much for school.

The Federal Reserve Bank of New York uses data from 1970 to 2013 to analyze, on average, how much “15 percent more” actually means.

The average annual income for people who earn their high school diploma is about $40,000.

If you earned an Associate’s Degree, it’s $50,000. Those with a Bachelor’s Degree earn more than $60,000.

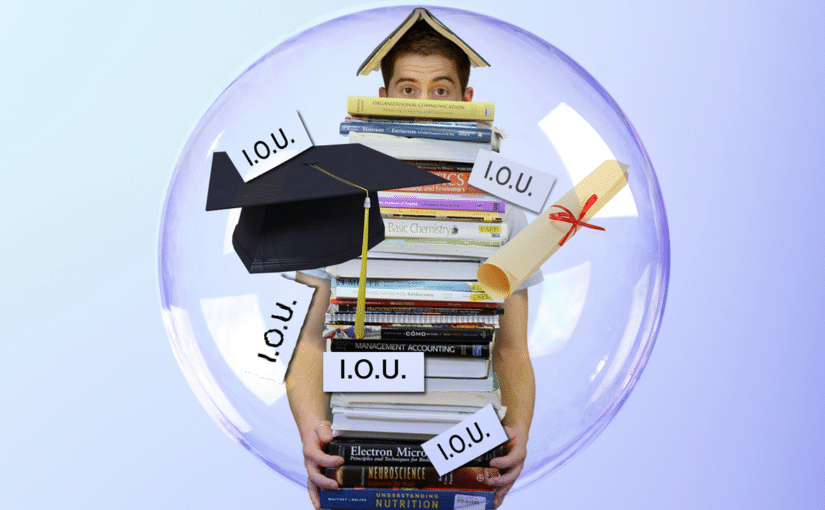

So there is a difference for college graduates and that’s good news. But those of us in the swamp of debt really do wonder if we will ever get out of it.

ConsumerMojo talked with social worker Nicole Falkman. She’s a graduate of St. Joseph’s College and earned a Master’s Degree at Stony Brook University and at 28 years old is $30,000 in debt. She put her loan in deferment, but knows that eventually she will have to face the music.

The reality of her situation got to her when she received multiple notices from her loan servicers in the mail. “I received my first loans which came in seven different envelopes,” she said. “It was $100 here, $200 there. It was very overwhelming.”

She told us, “It’s definitely something that hangs over our heads. It’s something that you feel like is always going to be there. It’s not like a car payment when you feel like there’s a short term with an end in sight. It almost buries you, like there’s no way out.”

Nicole’s colleague Mary Denning finds her student loan debt terrifying. Mary is 33, married with four kids and carries a student loan debt that almost hits the $200,000 mark. She told us that it prevents her and her husband from purchasing a home for their family. “I would be afraid of potentially losing that house if I have to go into student loan default. Anything your name is attached to is up for grabs if you can’t make those student loan payments,” she says.

Mary wonders if she would have been better off without a college education. “I have friends that are not college-educated who are doing better financially than I am,” she explains.

These are not isolated stories. Two thirds of those who graduated this year left school with some kind of debt. And the total student debt in the U.S. is more than $1.2 trillion.

All of us want to do the right thing and pay, we just need help figuring a way out. President Obama’s Pay As You Earn repayment plan keeps your student loan payments affordable. It caps your monthly payment at no more than 10 percent of your monthly income.

The Pay As You Earn plan helps, but the real problem is interest rates. Undergraduate borrowers face interest rates as high as 6.8 percent and graduate student borrowers face up to 7.9 percent if you borrowed money between 2006 and 2013.

This is higher than most rates on mortgages and car insurance. Homeowners and businesses are allowed the option to refinance but students can’t. Massachusetts Senator Elizabeth Warren (D) introduced a bill called the Students Emergency Loan Refinancing Act in June, but Senate Republicans killed it with a filibuster.

Mary Denning told us she blames high interest rates for her staggering student loan total. “My student loan debt is so high because of interest, that’s not what my actual education costs. But you know, when you have a principal [balance] and then $50-60,000 in interest, that’s another education. That’s got to stop.”

Mary, Nicole and I face the reality of our student debt every day. Our stories are not cliches, we are real people.

Help me tell your story. Comment below and let us know if you think college is really worth it.