by Nick Taylor

I’ve watched the Geico gecko pitching car insurance for so long now that I’m sick of the snarky little Aussie lizard. But my policy renewal is coming up this month and I decided to finally do some shopping and find out how to pay less for auto insurance.

Barbara and I have been with State Farm for over thirty years. We’ve had no accidents, filed one claim when somebody scraped the paint on our parked car, and I got a speeding ticket twenty-five years and three cars ago.

Barbara drives the car more than I do, and insists she’s a better driver. I say “Hah!” to that, but whichever of us takes the driving prize, between us we average fewer than 10,000 miles a year.

So I would have thought, between our driving and claims records, that we’d have seen a gradual reduction in premiums.

Not so. Instead, the bills we get every six months have fluctuated, but slowly increased. Since 2009, they’ve been as low as $800, as high as $900, and the most recent is for $875.

ConsumerMojo last December posted an advisory that longtime clients of the same insurer should question the bills they’re getting.

That’s because the insurers know we don’t like to shop around. And they use factors other than an insured’s driving record to set premiums. These factors, according to the Consumer Federation of America (CFA), are called “marketplace considerations” or “price optimization,” but they amount to the same thing.

It means that insurers look at their individual clients’ behavior – shopping behavior, not driving behavior — to set rates that can be as high as 800 percent too high.

“It’s really profit optimization,” J. Robert Hunter, a former Texas insurance commissioner, told ConsumerMojo. He works with the CFA now and says companies determine the price point when customers will leave, and set rates just below that point in order to keep them.

Hunter said, “CFA believes price optimization will always result in unfairly discriminatory pricing that is illegal everywhere.”

State Farm’s Arlene J. Lester told ConsumerMojo, “We do not base our premiums on studies that show how much a customer is willing to pay . . .” She added, “We do provide discounts for customers who have been crash-free for varying periods of time.”

Mileage driven is another factor companies use – or should use – in setting rates. People who drive less, typically older and lower- income drivers, have fewer accidents and claims.

They cost their insurers less and should get a break for that. But the companies don’t all do it. In fact, the CFA reported on May 21 that only State Farm “consistently rewards drivers for lower mileage.”

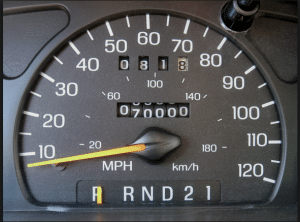

And that’s the first thing Nina Chen at the Meilee Fu Agency, my State Farm agent, asked when I told her I was shopping around: “How much do you drive?” I checked our odometer and reported that we’ve averaged under 7,500 miles a year since 2009.

She told me that was enough for a price break of around $300 a year. And in fact our latest bill, factoring in the lower mileage, dropped $146.83 to $728.48 for six months.

So if you’ve decided it’s time to start asking questions about your car insurance premium, that’s a good place to start. Once you’ve done that, ConsumerMojo also suggests that you ask your insurance company if they use price optimization or marketplace considerations, or data about your individual shopping practices, in setting your premiums.

I got caught up in that 2 years ago. I had been with Liberty Mutual for 30+ years and never shopped due to their having taken care of me and 3 teenage drivers as they started driving until getting out on their own. Then LM started surcharging auto and home insurance. I checked Hartford first then a couple of others, did not take the lowest offer and still saved $1500 a year on 3 cars and the house…goes to prove…you gotta shop around !!”