updated October 9, 2017

Credit report mistakes matter. Many of us routinely ignore our credit reports although the Equifax breach put a spotlight on them. It seems like a hassle to request them and then review all the details. But it is essential to review them.

A warning: the Equifax data hack made it more difficult to get your free credit report online and we explain why here.

But beyond the data hack, what’s on the credit report matters more than ever because employers routinely review credit reports to see what your payment history looks like. A mistake on your credit report can paint an inaccurate picture of you for a prospective employer.

Whether we like it or not, a credit report is now used by a wide range of companies and individuals to evaluate whether they want to do business with us. Landlords, for example, often review a credit report before renting to a prospective tenant.

Mistakes creep into credit reports because of inaccurate reporting by creditor, or because they fail to update payment information about you.

These mistakes often go undetected and most of us don’t realize the short and long term consequences. Checking your credit report is worth the effort and while you may not see immediate rewards, you’re basically taking charge of your financial history.

Consider this is a matter of sticking up for yourself and making sure that the records about you are correct.

Consumer Advocate Joby Thoyalil of the New Economy Project, formerly(NEDAP) explains why you need to check your credit report.

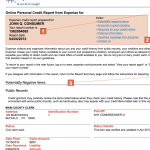

Ignore the online ads and use annualcreditreport.com. This is a collaboration of the three top credit reporting bureaus: Equifax, Experian,TransUnion. Federal law makes it possible for you to check your credit report for free three times a year.

![]() How to Improve My Credit-The Truth

How to Improve My Credit-The Truth