Take advantage of Medicare open enrollment and change your Part D plan. It’s a potentially smart move because you may save money.

Open Enrollment runs from October 15 until December 7th and while changing an insurance plan may seem like too much trouble, the savings can add up.

WHY CHANGE YOUR DRUG PLAN?

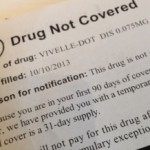

Your insurer may not list your drug on its “formulary.” The “formulary,” is what the insurer calls its list of approved drugs.

Every insurer has a variety of plans, and each plan has it’s own list of approved drugs. It’s maddening that there is not a uniform policy. But this is the way it is.

- Courtesy Creative Commons via Flickr

So even if you have a happy relationship with your insurer, they may have changed things up on you. It’s really important to check your mail. If you received a notice that said something about important changes, open it.

- Photo by ConsumerMojo.com

Don’t dump it on the pile of mail.

It’s likely that there is something in the notice that tells you the insurer has added approved drugs, or removed others. Check to see if your medication is on either list

Tip 1

- Make a list of your prescription drugs

- Match your list to what the plans offer

Tip 2

Check to see how your insurer categorizes your drug in its tier system.

The tier system is a complicated way of explaining that you’ll pay more for certain drugs.

Tier 1 drugs are cheaper, than Tier 2. Tier 3 drugs are more expensive than Tier 1 and Tier 2. And Tier 4 will cost you the most.

Tip 3

Read the rules the insurer outlines. It’s essential to know whether the company will require you to get prior approval or require you to use a generic drug for a test period called “Step Therapy.” In “Step Therapy,” it will require you to use a generic drug or several generic drugs before it approves a brand-name drug for payment.

Or, the insurer may limit the quantity of medication that you can get. It’s important to look at these rules because they can cost you money and make your life hellish if you don’t understand the benefits and the limitations.

CHECK TO SEE IF THE INSURER REQUIRES

- Prior approval

- Step Therapy

- Quantity Limits

![]() Medicare Basics for Boomers and Everyone Else

Medicare Basics for Boomers and Everyone Else

![]() Medicare Part B, Boomers and Costly Mistakes

Medicare Part B, Boomers and Costly Mistakes

![]() Choosing Power of Attorney Tips

Choosing Power of Attorney Tips

Nobody is talking about the lifetime penalities for taking Part D, if you did not take it when you got Medicare!The penalties cost as much, if not more, if you take a Medicare Advantage plan.I never enrolled in PartD at its inception because of the huge donut hole, and paid for my own meds.(meds in the US cost twice the Canadian cost)I am 79yrs old and wanted to get a Medicare Advantage plan, but the plan came with drug plan. The plan cost$50/mo but with the drug penality($40plus/mo for the rest of my life- I would still be betteroff getting my drugs from Canada)my cost would be $90/mo for a useless drug plan) I have tried to speak to my county rep, sent emails, etc, but nobody will do anything about the unreasonable penality law for the life of the enrollee! You are my last resort before enrollment closes.

Sheila, you may be eligible for subsidies to pay for your drugs. Do you know about that? Again, it would be great if you started a thread on our forum.