by Selvin Gootar

A plunge of 531 points in the Dow is a scary number, and for those even beginning to think about retirement, it may seem especially frightening.

But as many of us approach 50, we start thinking about two other numbers: the age that we can retire, and the amount of money we need to retire comfortably.

Sometimes, you need to revise the numbers. Maybe take a later retirement, or scale down or boost up your money plan. But it’s a valuable exercise to begin to think about what you want to do and how you’ll support yourself.

The recent roller coaster ride in the U.S. stock market, triggered by the devaluation of China’s currency, the weakness of emerging market economies, and falling oil prices reinforced fears for the future and caused many Americans to wonder: Can I afford to retire?

If you worked and contributed to Social Security you have options to take it at 62, 65, 66 or 70. So far so good. Some politicians call this an “entitlement.” But you paid into the retirement system and that’s why you can collect.

The other two parts of your money planning include savings and non-retirement investments, and pensions, IRAs, or 401(k)s. Former Esquire editor Lee Eisenberg raises an interesting point in The Number: A Completely Different Way to Think About the Rest of Your Life. He suggests asking yourself the question: “What is really going to make me happy…and what does that cost?”

So if you invest in the stock market, instead of focusing on assembling specific investments for your portfolio, focus on an approach that will likely help you to achieve your goals.

How can you do this? If you have the time or the inclination, you can do it by yourself. It’s not impossible.

A number of good investment books and websites offer advice. Over the years, I turned to classic investing books and found them very helpful.

A Random Walk Down Wall Street by Burton Malkiel

How to Buy Stocks by Louis C. Engel and Henry Hecht

One Up On Wall Street by Peter Lynch with John Rothchild

But you may need to find a good advisor. Be sure to work with an independent, fee-based, certified financial planner. Their rates vary, but some allow for smaller initial amounts to open an account. It’s likely they’ll work with you if you have $10,000 to $50,000 to invest.

Again, make sure the planning firm is completely independent and fee-based, not commission-based.

You want to formulate an investment mix that’s comfortable for you, that’s diversified, and includes equities, bonds, fixed income and real estate. If you spread your money around you have a better than average chance of reaching your goal.

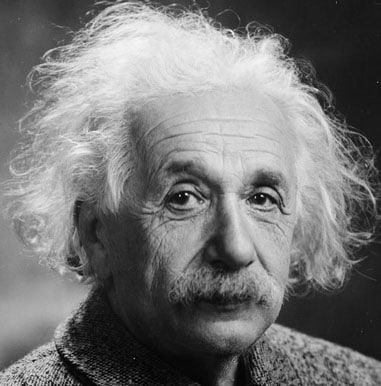

Let the power of compounding work for you. Compounding is the time it takes for money that’s invested to double in value. Albert Einstein said “compound interest is the greatest mathematical discovery of all time.”

Getting the mix right, or in the parlance of investment professionals – asset allocation – is recognized as being critical to the long-term success of your portfolio.

In a 1991 study published in the Financial Analysts Journal entitled “Determinants of Portfolio Performance,” asset allocation was credited with achieving over 91% of positive portfolio performance, far greater than the selection or the timing of individual investments. It’s the idea that you don’t put all your eggs in one basket, and don’t spend all your money to buy the eggs from one particular chicken.

In a slightly different context, it’s worth noting the advice of Clint Murchison, Jr., the Texas businessman and original owner of the Dallas Cowboys: “Money is like manure. If you pile it up, it stinks like hell. But if you spread it around, it can do some good.”

So spread it around, allocate your assets, be patient, don’t get spooked by fluctuations in the market, and let compound interest work its magic. Do you want to argue with Albert Einstein?