By Ronald Louis Peterson

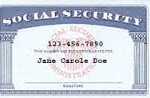

In three years, at 66, I’ll begin collecting my promised Social Security retirement and Medicare benefits. My daughter and son-in-law hope that they’ll be able to collect theirs in 40 years when they turn 70.

But we may be disappointed because these funds are set to run out soon if our government doesn’t revise the programs.

There are lots of proposals to fix Social Security and Medicare and not surprisingly they all involve providing reduced benefits.

The Obama administration and Republican leaders lean toward changing the formula that’s used to calculate the annual cost of living increase

Right now the cost-of-living allowance (COLA) is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI) prepared by the Federal Bureau of Labor Statistics. Those on Social Security get an annual increase that reflects the rise in prices of things we buy. In 2014 the Social Security cost of living increase will be 1.5 percent.

The proposed new formula lowers the increase because it would tie increases to something called the “chained” CPI.

The theory behind the chained CPI is that it more accurately reflects how we spend our money when prices go up.

It assumes that we revise our budgets downward when things cost too much. For example, if steak is high you buy might buy chicken instead. Or when car prices rise, you might hold on to your old vehicle or buy a less expensive model. So you really don’t spend more money. That’s the theory.

The chained CPI is about o.25 percentage points lower than the CPI, and that doesn’t sound like much. But the cuts compound and could save Social Security about $130 billion during the first ten years.

It would also cost those who receive the checks.

The AARP is one of many groups that oppose the chained CPI and insists it’s not a more accurate reflection of the cost of living.

In a letter to the House Ways and Means Committee, AARP Director of Financial Security and Consumer Affairs Cristina Martin Firvida wrote, “The adoption of chained CPI would take approximately $340 billion dollars out of the pockets of current and near retirees, working families, veterans and the disabled, as well as the local economies in which they live, in the next 10 years alone.”

Current and future retirees would be negatively affected, according to Max Richtman,President and CEO of the National Committee to Preserve Social Security and Medicare.

Richtman told ConsumerMojo,”Cutting benefits by adopting the chained CPI would cut the COLA by 3% for workers retired for ten years and 6% for workers retired for twenty years. Three years after enactment, this translates to a benefit cut of $130 per year in Social Security benefits for a typical 65-year-old. The cumulative cut for that individual would be $4,631 or more than three months of benefits by age 75.”

And there’s more. The National Active and Retired Federal Employees Association (ARFE) says, “Lower COLAs would hurt seniors, who are already facing increasing medical costs, which even the current method does not adequately weigh.”

ARFE offers a calculator so that you can see for yourself what you may lose

REALITY CHECK

But there is also the reality of the dwindling fortunes of Social Security.

According to the Social Security Administration, the Social Security Disability Insurance fund will become insolvent in 2016, triggering an immediate 20 percent cut in benefits.

Medicare will become insolvent in 2026, triggering an immediate 13 percent cut and the Social Security Retirement Fund will become insolvent in 2033, triggering an immediate 25 percent cut.

How did this happen? According to the Financial Planning Association, back in 1983, Social Security funds were to be invested in a way that would enable the fund to grow and protect the system for 75 years or until the year 2058.

Instead, a system was created where the funds were put into non-negotiable treasury bonds, a government IOU, so Congress could use these dollars to spend on general government expenses.

It sounds like government mismanagement to me and yet those who made that costly decision have not been held accountable.

Come to think of it, the same thing happened following our government’s decisions that helped spark the global financial collapse and the billions of dollars wasted in the subsequent stimulus program.

A lot of good money chased the bad. Meanwhile, the consequences of the Federal Reserve’s $85 billion monthly bond buying to drive down interest rates, referred to as “quantitative easing,” may also turn out to be very painful for most of us. Yes, there’s a definite pattern here.

In fairness, other factors contribute to the pending deficits in Social Security and Medicare including an aging population, fewer younger workers, millions of unemployed workers, fraud and waste and abuse.

WHO ACTS?

Isn’t it government’s responsibility to deal with these things before acting, not after, when making policy and laws?

Somebody should remind our “leaders” of this. The lack of competence displayed by our government scares me.

The bottom line is that if we don’t demand more responsibility from our government, we’ll have nobody to blame but ourselves for our lower standard of living.